- For educators

- English (US)

- English (India)

- English (UK)

- Greek Alphabet

This problem has been solved!

You'll get a detailed solution that helps you learn core concepts.

Question: Most business plan writers interpret or make sense of a firm's historical and/or pro forma financial statements through ____________ analysis.Group of answer choicesassumptionsrelativeratioproportion

- **Assumptions**: This involves making educated g...

Not the question you’re looking for?

Post any question and get expert help quickly.

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

10 Qualities of a Good Business Plan Explained

9 min. read

Updated August 1, 2024

What makes a good business plan?

Results.

Goals met, milestones achieved, objectives accomplished.

Forget the old-fashioned thinking of evaluating plans like a college term paper. You don’t get points for writing style, formatting, or completeness.

A good business plan shows you can get results. But what does that look like in practice? What should you focus on when writing?

Well, I’ve narrowed it down to 10 key qualities. Qualities I’ve found make for the best business plans and, ultimately, more successful businesses.

- 1. It fits the business need

You have to consider why you need a business plan in the first place. Business plans aren’t one-size-fits-all . Form follows function.

Not all business plans have to be pretty

Most business plans exist to help run the company , not to be presented to outsiders. They don’t have to be polished and formal; they just need to work for you and be easy to review, revise, and run your business.

Write it for your audience

A business plan being shown to outside investors does, in fact, have to look good, read well, and be presentation-worthy. It needs good summaries and descriptions to validate the idea, the team, the market, and other key elements. It should also describe how you intend to exit in the future.

The business plan to support a loan application also needs summaries and descriptions. They need to reassure a lender about risk, usually with assets, often with the owner’s personal financial statements, and past performance on credit ratings and debt repayment.

2. It’s realistic and can be implemented

The second measure of a good or bad business plan is realism. You don’t get points for ideas that can’t be implemented. Setting unrealistic and unachievable goals is a waste of time.

For example, a brilliantly written, beautifully formatted, and excellently researched business plan for a product that can’t be built is not a good business plan. A plan that requires millions of dollars of investment but lacks a management team to get that investment is not a good plan.

A plan that ignores a fatal flaw is not a good plan. Make sure your goals are achievable.

For example, if you share a financial forecast , is it realistic? Based on current revenue, can you realistically achieve your goals? If you’ve brought in $200,000 annually in revenue for the last few years, don’t expect to jump to $400,000 in the next quarter.

Make a plan for increasing revenue—but in increments that make sense and are achievable. Look at changes in revenue drivers, such as traffic, web views, sales per store, etc. Get into the details.

Link your projected increases to actions and events, such as milestones, promotions, a new product launch, or a new location. Think of the power of cause and effect. Increases are more real when they result from activities and events, not just out of the blue.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

3. It’s specific and measurable

Every business plan should include tasks, deadlines, dates, forecasts, budgets, and metrics. These will make your plan measurable .

Ask yourself:

- How will we know if we followed the plan?

- How will we track actual results and compare them against the plan?

- How will we know if we are on track or not?

While high-end strategy can be fun to develop, good planning depends more on what, when, who, and how much. These are the concrete specifics that offer visibility into the real progress toward your goals.

- 4. It clearly defines responsibilities for implementation

You have to be able to identify a single person who will be responsible for every significant task and function. A task that doesn’t have an owner isn’t likely to be implemented.

You should be able to review a business plan and recognize who is responsible for implementation at every point. If you don’t, you have a gap and need to fill it.

Avoid sharing responsibilities between different people or groups because this reduces accountability. Match every important task or function with one person in charge and accountable.

Again, if you don’t have that person right now, don’t just ignore it. Mention in your plan that it’s a known gap, when you intend to address it, and if you have anyone in mind.

- 5. It clearly identifies assumptions

Business plans are always wrong. They’re written by humans who are making guesses about the future. Humans tend to guess wrong.

So, your business plan must clearly address assumptions upfront.

Did you assume the company will increase productivity by 10% this year because it did the last few years? Do you assume the market won’t change much? No new competitors? Do you assume that your technology will reduce your direct costs? Do you assume growth in your social media impact?

Share your thoughts on why this is achievable based on past factors, but also clarify that you’re guessing.

You may need to update or refine these areas of your plan after a few months. By flagging them as assumptions from the start, you won’t be surprised when you over or underperform and are prepared to revisit and adjust.

- 6. It defines strategy and tactics

In the real world, a small business can’t do everything, so it has to do the right things. You can’t please everybody, so you need to please the right people. That is the essence of strategy.

A strategy defines what problem you solve, the solution you offer, the relevant target market, and why you are the one to do it.

How you treat strategy in a business plan depends on the nature and objective of the plan itself.

Strategy can be as simple as a bulleted list taking up a page or two of a lean business plan. It could also be one or more slides in a pitch deck or a more detailed formal chapter of a traditional plan.

The plan defines the strategy so you can refer back to it as often as necessary. It might be there for management value or to explain to outsiders. And who will be using or looking at it will dictate how it needs to be presented.

Get into the details

Strategy is useless without the key tactics .

Tactics might be pricing, distribution, marketing, financial plans, sales plans, etc. Make sure the tactics you choose are directly in service of executing your strategic goal.

You should be able to explain how every action you take relates to your overall business strategy. And don’t leave tactics without developing concrete specifics, milestones, budgets, tasks, responsibility assignments, tracking, and how you’ll follow up.

- 7. It incorporates a monthly review schedule

Good business plans include timing and schedules for regular updates. You anticipate the need for a regular monthly review .

You know your plan is not perfect and needs to be revised to accommodate ongoing results. Real business plans need to be kept fresh.

- 8. It includes essential numbers

Sure, there is a place for a simpler one-page business plan and other shorter plan summaries. Investors, banks, and strategic partners might want that kind of simple summary to quickly understand your business.

But real business runs on cash, and keeping your business in cash requires thorough financial planning.

You need budgets and tracking.

So a real business plan includes essential financial projections , including sales, costs of sales, expenses, profits, and cash flow.

You track sales, costs, and expenses to monitor related budgets and progress toward goals. You also track cash flow factors such as accounts receivable and inventory to look for indications of change that might require management actions.

Remember that management is about constant course corrections. This is why you include a regular monthly review of the plan against your actual results.

9. It’s clear and simple

Keep it simple.

Most businesses need and will use a lean business plan , which can be just a few pages of bullet point lists (strategy, tactics, milestones, etc.) and tables (sales, costs, expenses, profits, cash flow).

Don’t use a business plan to show off.

A business plan is about the business, not the science. Avoid industry jargon and long technical explanations. Investors and bankers will have experts review your details, but they don’t expect to find them all in the plan document.

Related Reading: How long should your business plan be?

- 10. Easy to communicate with the right people

Again, form follows function.

For example, an internal plan to manage your business is not lengthy and formal. Instead, it links key elements together to make them easy for team members to access and work on.

If you do have to present the plan, make the text business-appropriate.

Take the time and trouble to avoid typos and spelling errors. Use outlines and summaries to make the more important points easy to find. Make font sizes clean and large enough for older readers. Have somebody else read it before you finish.

This makes it professional and shows respect for the reader and the business situation. It should also be presented in a format that lends itself to sharing, like a website or PDF document.

Security is important too. Is the plan safely locked away from the prying eyes of outsiders? Most business plans live online or on local networks where team members can access and manage. Some are online, and outsiders can see them. In both cases, use security safeguards.

Ongoing planning process: it’s about the management it causes

U.S. president and military strategist Dwight D. Eisenhower is often quoted as saying:

The plan is useless, but planning is essential .

The key point is that no clear criteria exists to tell you if a business plan is good or bad.

What makes a business plan useful (good) is the management that comes out of it. The regular reviews and revisions that help you stay on track. That’s good planning , as opposed to just a good plan.

To start your own planning on the right foot, download our free business plan template . It provides the structure and guidance needed to create a good business plan and can be adapted to fit your meeds.

Tim Berry is the founder and chairman of Palo Alto Software , a co-founder of Borland International, and a recognized expert in business planning. He has an MBA from Stanford and degrees with honors from the University of Oregon and the University of Notre Dame. Today, Tim dedicates most of his time to blogging, teaching and evangelizing for business planning.

Table of Contents

- 2. It’s realistic and can be implemented

- 3. It’s specific and measurable

- 9. It’s clear and simple

- Ongoing planning process: it’s about the management it causes

Related Articles

3 Min. Read

Celebrate National Write a Business Plan Month in December

14 Min. Read

15 Ways to Use and Get Incredible Value From a Business Plan

7 Min. Read

8 Reasons Business Plans Fail That No One Wants to Talk About

6 Min. Read

Do This One Thing Before You Write Your Business Plan

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

- Starting a Business

- Growing a Business

- Business News

- Science & Technology

- Money & Finance

- For Subscribers

- Write for Entrepreneur

- Tips White Papers

- Entrepreneur Store

- United States

- Asia Pacific

- Middle East

- United Kingdom

- South Africa

Copyright © 2024 Entrepreneur Media, LLC All rights reserved. Entrepreneur® and its related marks are registered trademarks of Entrepreneur Media LLC

The Essential Guide to Writing a Business Plan Here's the no-nonsense guide on how to write a business plan that will help you map success for your startup.

By Carolyn Sun

Opinions expressed by Entrepreneur contributors are their own.

President Dwight D. Eisenhower once said, "In preparing for battle I have always found that plans are useless, but planning is indispensable." If you're starting a business, you should have a business plan regardless of whether you're bootstrapping it or looking for outside funding.

The best sorts of business plans tell a clear story of what the company plans to do and how it will do it. Given the high failure rate of startups in their first year, a business plan is also an ideal opportunity to safely test out the feasibility of a business and spot flaws, set aside unrealistic projections and identify and analyze the competition.

A business plan doesn't need to be complicated, but for it to serve its purpose and set you up for success, it must be clear to whomever is reading your plan that you have a realistic handle on the why and how your business will be a success.

To get you moving in the right direction, here's a guide on how to write a business plan.

Overall tips

There's a lot of advice in the infosphere about how to write a business plan, but there's no single correct way. Your approach depends on your industry, who is reading your plan and what the plan is intended for. Are you trying to get funding? Sara Sutton Fell, founder of FlexJobs , a job site for flexible telecommuting jobs, says her business plan was an initiator for more in-depth conversation with potential investors. "A plan does help to see if investors and entrepreneurs are on the same page with general expectations for the business," she says.

A business plan serves many purposes, but there is universal consensus on the following when it comes to your business plan:

Have several versions tailored for specific audiences: "One of the mistakes that inexperienced business owners make is not understanding who they're writing the plan for," says David Ciccarelli, a small business owner who got consultation from his local Small Business Association (SBA) when he was starting his company Voices.com , which connects employers with voiceover talent.

Your plan is a living document: Tim Berry, the founder of a business planning software company Palo Alto Software , took his company from zero to $5 million in sales in its first three years. To do so requires frequent review and close tracking, says Berry, who met with his management team every month to review the plan versus what actually happened -- and then to revise. "There is no virtue to sticking to a plan if it's not useful and responsive to what actually happens," he cautions.

Be realistic about financial estimates and projections: "When you present a plan to bankers and financiers, or even to your employees, people will get way more excited about what's real rather than some huge thing that's never going to happen," says Ciccarelli. So present an achievable sales forecasts based on bottom-upwards information (i.e. how many units per month get sold in how many stores) and stop over projecting profits.

Writing your business plan is about the process and having a blueprint: Your business plan "reflects your ideas, intuitions, instincts and insights about your business and its future," according to Write Your Business Plan (Entrepreneur, 2015). The plan serves as a safe way to test these out before you commit to a course of action. And once you get your business going, the plan also serves as a reference point. "I still print the document," says Ciccarelli. "You're capturing it in time. If you're changing it all the time, you kind of don't remember where you were last year."

Back up any claims: Follow up your projections and assertions with statistics, facts or quotes from a knowledgeable source to lend your plan credibility.

Presentation counts: Reading any long, text-heavy document is hard on the eyes, so format with this in mind. Consider formatting your text pages into two-columns and break up long passages with charts or graphs. Arial, Verdana or Times New Roman are standard industry fonts.

Writing your business plan isn't busy work or a luxury; it's a vital part of the process of starting a business and arms you with information you need to know. So, let's get into what information goes into your business plan.

Related: Bu siness Plans: A Step-by-Step Guide

What goes into a business plan?

A typical business plan is 15 to 25 pages. Its length depends on a variety of factors, such as whether your business is introducing a new product or belongs to a new industry (which requires explanation to the reader), or if you're pitching to bankers, who generally expect to see a traditional written business plan and financials.

"Most equity investors prefer either an executive summary or pitch deck for first contact, but will often request a more detailed plan later in the due diligence process. Potential customers don't need all the details of your internal operation. Your management team needs access to everything," says Akira Hirai, managing director of business plan consulting service Cayenne Consulting .

Most business plans include these seven sections:

1. Executive summary : The executive summary follows the title page and explains the fundamentals of your business. It should provide a short and clear synopsis of your business plan that describes your business concept, financial features and requirements (i.e. cash flow and sales projections plus capital needed), your company's current business position (i.e. its legal form of operation, when the company was formed, principals and key personnel) and any major achievements in the company that are relevant to its success, including patents, prototypes or results from test marketing.

2. Business description : This section typically begins with a brief description of your industry and its outlook. Get into the various markets within the industry, including any new products that will benefit or hurt your business. For those seeking funding, reinforce your data with reliable sources and footnote when possible. Also provide a description of your business operation's structure (i.e. wholesale, retail or service-oriented), who you will sell to, how you will distribute your products/services, the products/services itself (what gives you the competitive edge), your business's legal structure, your principals and what they bring to the organization.

Here are some worksheets from Write Your Business Plan that will help determine your unique selling proposition and analyze your industry.

Click to Enlarge+

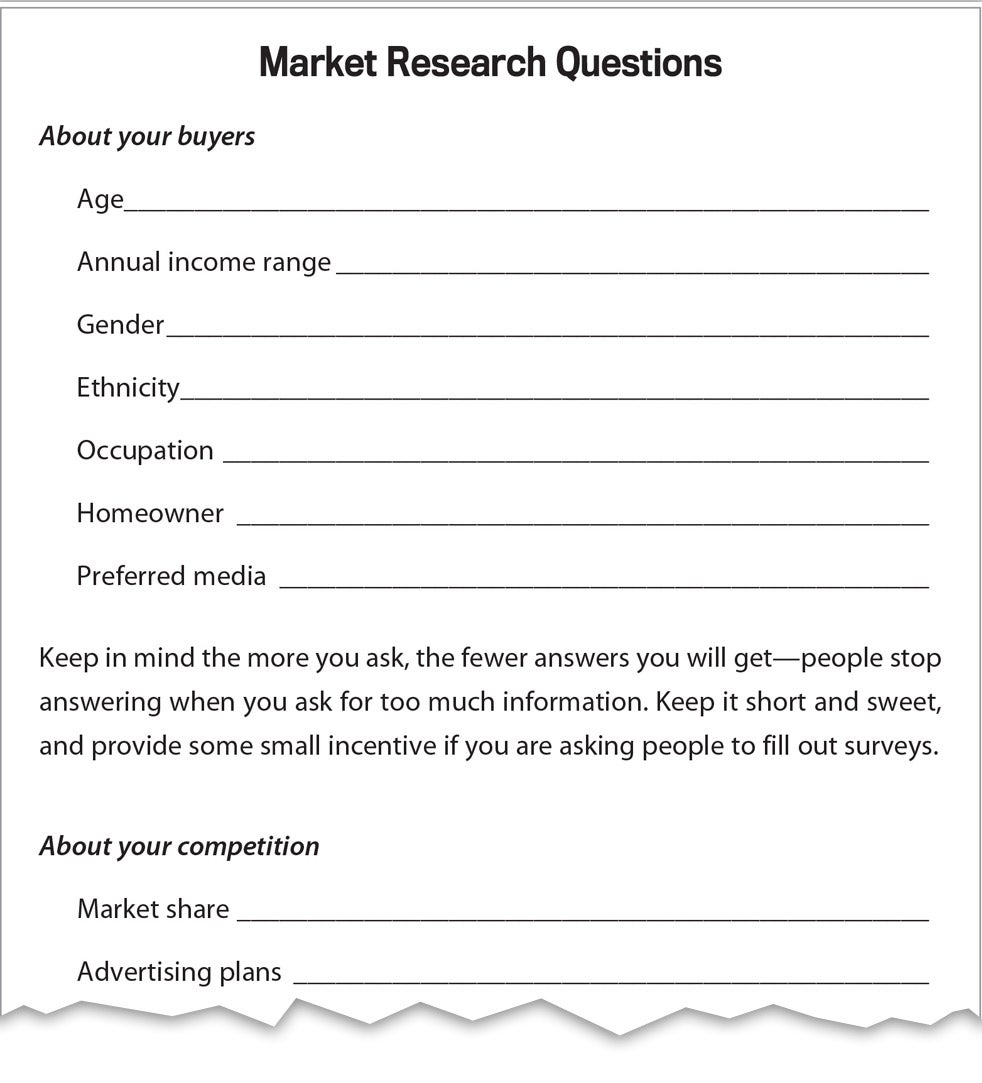

3. Market strategies: Here is where you define your target market and how you plan to reach them. Market analysis requires research and familiarity with the market so that the target market can be defined and the company can be positioned (i.e. are you a premium product or a price-competitive product?) in order to garner its market share. Analyze your market in terms of size, structure, growth prospects, trends and sales/growth potential. This section also talks about distribution plans and promotion strategy and tactics that will allow you to fulfill your plans.

Here is a worksheet from Write Your Business Plan that will guide you toward identifying your target market.

4. Competitive analysis: The purpose of the competitive analysis is to determine the strengths and weaknesses of the competitors within your market, strategies that will provide you with a distinct advantage, the barriers that can be developed in order to prevent competition from entering your market, and any weaknesses that can be exploited within the product development cycle. Show why your business will be a success over others.

5. Design and development plan: You will only need this section if you have a product in development, such as an app. The purpose of this section is to provide investors with a description of the product's design, chart its development within the context of production and marketing and show a development budget that will enable the company to reach its goals.

6. Operations and management plan: This section describes how the business functions on a daily basis, its location, equipment, people, processes and surrounding environment. If you have a product that needs to be manufactured, explain the how and where; also, describe your work facility, the personnel, the legal environment (such as licensing, permits, special regulations, etc.), key suppliers and inventory. This section will also highlight the logistics of the organization such as the various responsibilities of the management team and the tasks assigned to each division within the company.

7. Financial factors: Financial data is always at the back of a business plan -- yet it's extremely important. The financial data can include your personal financial statement, startup expenses and capital, your projected cash flow statement and 12-month profit-and-loss statement. PaloAlto's Berry stresses that if you're going after investors, you'll need to show a cash flow statement and a break-even analysis -- or the breakdown to see where your business breaks even.

The best way to prepare for running a business is to have all the components of the plan ready. So if you are are showing a prospective lender your business plan on 10 PowerPoint slides and get asked about something that isn't in the presentation, you can speak knowledgeably and follow up with a more fleshed out plan -- and quickly.

Some business owners hire business plan writing services. Cayenne Consulting's Hirai says that his clients generally fall into one of two categories: those intimidated by the process and those who could write the plan themselves but would prefer to spend their time on other priorities.

If you find yourself intimidated or stuck, you can always write the parts of plan yourself that you understand and hire a consultant or researcher to help with parts that you find confusing.

Or if you're a startup watching every dollar, then tap the free services of the federal Small Business Association (SBA). Every state has a district office . Through the SBA, you can get business plan assistance through its various resource partners, which includes Women's Business Centers , Small Business Development Centers and Service Corps of Retired Executives .

Allow this business plan template for Business Plan for a Startup Business to guide you:

Different types of business plans

Generally, business plans can be divided into four categories :

Working plan: This plan is what you will use to operate your business and is not meant to be admired. This version of your plan is an internal document and will be long on detail, short on presentation. Here, you can omit descriptions that you need not explain to yourself or your team.

Mini plan: The reader may request a mini plan, or a condensed version of your business plan (1-10 pages), which includes most of the same components as in a longer traditional plan -- minus the details and explanation. This includes the business concept, financing needs, marketing plan, financial statements (especially cash flow), income project and balance sheet. This shorter plan is not meant to be a substitute for a full-length plan, but serves as an option to present to potential partners or investors.

Presentation plan: Whether you're using a pitch deck or a written business plan, the information in your presentation plan will be, more or less, the same as in your working plan but worded differently and styled for the eyes of an outsider. The reader of your presentation plan will be someone who is unfamiliar with your business, such as investor or venture capitalist, so lose any jargon or shorthand from your working plan, which only makes sense to you. Also, keep in mind that investors will want to see due diligence on your competition threats and risks as well as financial projections. In addition, looks count, so use the color printer, a nice cover and bindings and the fancy paper stock. Or else, if you're presenting your business plan as a PowerPoint presentation, you can use this business plan presentation template .

What-if plan: This is a contingency plan -- in case your worst case scenario happens, such as market share loss, heavy price competition or defection of a key member of your team. You want to think about what to do in the face of an of these, and if you're trying to get outside funds, having a contingency plan shows that you've considered what to do if things don't go according to plan. You don't necessarily need this, but if you are getting outside funding, then it can strengthen your credibility showing that you have thought about these what-if possibilities. Even if you're not going to get outside funding, shouldn't you be thinking of the what ifs?

If four plans seem like a mountain of work, don't panic. Select two to start off -- a working plan and a mini plan, which will be an abbreviated version of your working plan.

Take several months to write your business plan. Consider it a journey, not a sprint.

Related: The Ultimate Guide to Writing a Business Plan

Carolyn Sun is a freelance writer for Entrepreneur.com. Find out more on Twitter and Facebook .

Want to be an Entrepreneur Leadership Network contributor? Apply now to join.

Editor's Pick Red Arrow

- These Married Co-Founders Started a Business With a Name 'Nobody Could Pronounce' — Then Bootstrapped It From Their Garage to 8-Figure Revenue

- Lock I Used a 'Lazy Girl Job' to Increase My Income 10x — Here's How You Can Do It Too in 2025

- There Are Certain Words That Will Break ChatGPT. I Tried Them — Here's What Happened.

- Lock She Started a Side Hustle That Earned More Than $1 Million in Year 1: 'Manifest Your Best Life'

- Subway's CEO Steps Down Amid a Major Transition for the Sandwich Giant

- Lock How I Turned One Laundromat Into 24 Overlooked Businesses Making Tens of Millions — and You Can, Too

Most Popular Red Arrow

These companies offer the best work-life balance, according to employees.

The ranking is based on Glassdoor ratings and reviews.

Why Your AI Strategy Will Fail Without the Right Talent in Place

Using fractional AI experts through specialized platforms allows companies to access top talent cost-effectively, drive innovation and scale agile strategies for growth.

Here's What the CPI Report Means for Your Wallet, According to JPMorgan and EY Experts

Most experts agree that there will be another rate cut next week.

Elon Musk Is Still the Richest Person in the World and Just Hit a Record Net Worth of Over $400 Billion. Here's How.

Several factors have helped the world's richest person reach the milestone.

6 Habits That Help Successful People Maximize Their Time

There aren't enough hours in the day, but these tips will make them feel slightly more productive.

Why Business Owners Should Streamline Their Operations Now for Success in 2025

As the holiday season and year-end approach, business owners face heightened operational demands, from inventory management to spend control. By streamlining these processes and partnering with flexible suppliers, businesses can maintain efficiency, meet customer needs and focus on growth while navigating this busy period.

Successfully copied link

COMMENTS

Most business plan writers interpret or make sense of a firm's historical and/or financial statements through. ratio analysis. which of the following is the main purpose for writing a business plan? A. Plan helps the company develop a "road map" to follow B. Plan introduces potential and other stakeholders to the business opportunity C.

Summary business plan, full business plan, operational business plan Most business plan writers interpret or make sense of a firm's historical and/ or pro financial statements through Assumptions analysis

Most business plan writers interpret or make sense of a firm's historical or pro forma financial statements through _____. A firm's employees and investors. Other stakeholders. What are the two primary audiences for a firm's business plan? Both a and b are equally important.The plan helps the company develop a "road map" to follow.The plan ...

Question: Most business plan writers interpret or make sense of a firm's historical and/or pro forma financial statements through _____ analysis.Group of answer ...

Businesses that use a formal business plan are 30 percent more likely to succeed, according to research by the University of Oregon. Whether you are starting a new business or are currently in ...

Here's the best step-by-step template for writing the perfect business plan when creating your startup. Be Honored as an Inc. Best Workplace. Early-Rate Deadline THIS FRIDAY, 12/13.

Drafting the Summary. An executive summary is an extremely important first step in your business. You have to be able to put the basic facts of your business in an elevator pitch-style sentence to ...

Make a plan for increasing revenue—but in increments that make sense and are achievable. Look at changes in revenue drivers, such as traffic, web views, sales per store, etc. Get into the details. Link your projected increases to actions and events, such as milestones, promotions, a new product launch, or a new location.

Mini plan: The reader may request a mini plan, or a condensed version of your business plan (1-10 pages), which includes most of the same components as in a longer traditional plan -- minus the ...

A) the amount of money a business needs to make to pay all of its employees B) the amount of money a business needs to make to pay all of its expenses C) the amount of money a business needs to make The deviation from the traditional methods used to interpret an accounting rule or standard is called: a.