- Auto Insurance Best Car Insurance Cheapest Car Insurance Compare Car Insurance Quotes Best Car Insurance For Young Drivers Best Auto & Home Bundles Cheapest Cars To Insure

- Home Insurance Best Home Insurance Best Renters Insurance Cheapest Homeowners Insurance Types Of Homeowners Insurance

- Life Insurance Best Life Insurance Best Term Life Insurance Best Senior Life Insurance Best Whole Life Insurance Best No Exam Life Insurance

- Pet Insurance Best Pet Insurance Cheap Pet Insurance Pet Insurance Costs Compare Pet Insurance Quotes

- Travel Insurance Best Travel Insurance Cancel For Any Reason Travel Insurance Best Cruise Travel Insurance Best Senior Travel Insurance

- Health Insurance Best Health Insurance Plans Best Affordable Health Insurance Best Dental Insurance Best Vision Insurance Best Disability Insurance

- Credit Cards Best Credit Cards 2024 Best Balance Transfer Credit Cards Best Rewards Credit Cards Best Cash Back Credit Cards Best Travel Rewards Credit Cards Best 0% APR Credit Cards Best Business Credit Cards Best Credit Cards for Startups Best Credit Cards For Bad Credit Best Cards for Students without Credit

- Credit Card Reviews Chase Sapphire Preferred Wells Fargo Active Cash® Chase Sapphire Reserve Discover It® Cash Back Discover It® Student Chrome Discover It® Student Cash Back Chase Ink Business Unlimited American Express Blue Business Plus

- Credit Card by Issuer Best Chase Cards Best Discover Cards Best American Express Cards Best Visa Credit Cards Best Bank of America Credit Cards

- Credit Score Best Credit Monitoring Services Best Identity Theft Protection

- CDs Best CD Rates Best No Penalty CDs Best Jumbo CD Rates Best 3 Month CD Rates Best 6 Month CD Rates Best 9 Month CD Rates Best 1 Year CD Rates Best 2 Year CD Rates Best 5 Year CD Rates

- Checking Best High-Yield Checking Accounts Best Checking Accounts Best No Fee Checking Accounts Best Teen Checking Accounts Best Student Checking Accounts Best Joint Checking Accounts Best Business Checking Accounts Best Free Checking Accounts

- Savings Best High-Yield Savings Accounts Best Free No-Fee Savings Accounts Simple Savings Calculator Monthly Budget Calculator: 50/30/20

- Mortgages Best Mortgage Lenders Best Online Mortgage Lenders Current Mortgage Rates Best HELOC Rates Best Mortgage Refinance Lenders Best Home Equity Loan Lenders Best VA Mortgage Lenders Mortgage Refinance Rates Mortgage Interest Rate Forecast

- Personal Loans Best Personal Loans Best Debt Consolidation Loans Best Emergency Loans Best Home Improvement Loans Best Bad Credit Loans Best Installment Loans For Bad Credit Best Personal Loans For Fair Credit Best Low Interest Personal Loans

- Student Loans Best Student Loans Best Student Loan Refinance Best Student Loans for Bad or No Credit Best Low-Interest Student Loans

- Business Loans Best Business Loans Best Business Lines of Credit Apply For A Business Loan Business Loan vs. Business Line Of Credit What Is An SBA Loan?

- Investing Best Online Brokers Top 10 Cryptocurrencies Best Low-Risk Investments Best Cheap Stocks To Buy Now Best S&P 500 Index Funds Best Stocks For Beginners How To Make Money From Investing In Stocks

- Retirement Best Roth IRAs Best Gold IRAs Best Investments for a Roth IRA Best Bitcoin IRAs Protecting Your 401(k) In a Recession Types of IRAs Roth vs Traditional IRA How To Open A Roth IRA

- Business Formation Best LLC Services Best Registered Agent Services How To Start An LLC How To Start A Business

- Web Design & Hosting Best Website Builders Best E-commerce Platforms Best Domain Registrar

- HR & Payroll Best Payroll Software Best HR Software Best HRIS Systems Best Recruiting Software Best Applicant Tracking Systems

- Payment Processing Best Credit Card Processing Companies Best POS Systems Best Merchant Services Best Credit Card Readers How To Accept Credit Cards

- More Business Solutions Best VPNs Best VoIP Services Best Project Management Software Best CRM Software Best Accounting Software

- Debt relief Best debt management Best debt settlement Do you need a debt management plan? What is debt settlement? Debt consolidation vs. debt settlement Should you settle your debt or pay in full? How to negotiate a debt settlement on your own

- Debt collection Can a debt collector garnish my bank account or my wages? Can credit card companies garnish your wages? What is the Fair Debt Collection Practices Act?

- Bankruptcy How much does it cost to file for bankruptcy? What is Chapter 7 bankruptcy? What is Chapter 13 bankruptcy? Can medical bankruptcy help with medical bills?

- More payoff strategies Tips to get rid of your debt in a year Don't make these mistakes when climbing out of debt How credit counseling can help you get out of debt What is the debt avalanche method? What is the debt snowball method?

- Manage Topics

- Investigations

- Visual Explainers

- Newsletters

- Abortion news

- Climate Change

- Corrections Policy

- Sports Betting

- Coach Salaries

- College Basketball (M)

- College Basketball (W)

- College Football

- Concacaf Champions Cup

- For The Win

- High School Sports

- H.S. Sports Awards

- Scores + Odds

- Sports Pulse

- Sports Seriously

- Women's Sports

- Youth Sports

- Celebrities

- Entertainment This!

- Celebrity Deaths

- Policing the USA

- Women of the Century

- Problem Solved

- Personal Finance

- Consumer Recalls

- Video Games

- Product Reviews

- Home Internet

- Destinations

- Airline News

- Experience America

- Great American Vacation

- Ingrid Jacques

- Nicole Russell

- Meet the Opinion team

- How to Submit

- Obituaries Obituaries

- Contributor Content Contributor Content

Personal Loans

Best personal loans

Auto Insurance

Best car insurance

Best high-yield savings

CREDIT CARDS

Best credit cards

Advertiser Disclosure

Blueprint is an independent, advertising-supported comparison service focused on helping readers make smarter decisions. We receive compensation from the companies that advertise on Blueprint which may impact how and where products appear on this site. The compensation we receive from advertisers does not influence the recommendations or advice our editorial team provides in our articles or otherwise impact any of the editorial content on Blueprint. Blueprint does not include all companies, products or offers that may be available to you within the market. A list of selected affiliate partners is available here .

How to start a business with no money in 2025

Cat McAlpine

Sierra Campbell

“Verified by an expert” means that this article has been thoroughly reviewed and evaluated for accuracy.

Updated 4:16 a.m. ET Oct. 4, 2024

- path]:fill-[#49619B]" alt="Facebook" width="18" height="18" viewBox="0 0 18 18" fill="none" xmlns="http://www.w3.org/2000/svg">

- path]:fill-[#202020]" alt="Email" width="19" height="14" viewBox="0 0 19 14" fill="none" xmlns="http://www.w3.org/2000/svg">

Editorial Note: Blueprint may earn a commission from affiliate partner links featured here on our site. This commission does not influence our editors' opinions or evaluations. Please view our full advertiser disclosure policy .

kate_sept2004, Getty Images

Running your own business comes with freedom, flexibility and, possibly, great financial success. However, starting a successful business can be expensive. What if you have a great idea but no savings? Luckily, there are many ways to start a business with no money.

Read on to explore businesses with no startup costs, plus learn how to create your business plan, seek funding and successfully establish your business.

Editor’s Note: This article contains updated information from a previously published story.

Featured LLC service offers

Zenbusiness.

Via ZenBusiness’ website

$0 + State fees

Service time

Varies by state & package

Northwest Registered Agent

Via Northwest Registered Agent’s website

$39 + State fees

Tailor Brands

Via Tailor Brands’ website

$0 + state fee

1. Come up with a business idea

Some businesses are easier to start than others. Starting a bakery, for example, requires special skills, a passion for baking and a lot of overhead costs. But there are plenty of ventures that require no money upfront.

To tap into one, think about the skills you already have and the resources currently available to you. Your work doesn’t have to be something you’re incredibly passionate about, but it should be something you are competent in and can enjoy.

For example, if you have specific skills in writing, management, design or any kind of content production, you may be able to freelance as an individual. If you have broader skills like being extremely organized or good at multitasking, you may find that something like dropshipping works best for you.

Don’t be afraid to explore an idea, going so far as to develop a business plan, before deciding if it’s right for you. Seeing the big picture next to the expected day-to-day intricacies will give you a good idea of what a business will be like to operate and if it can be successful.

Below are some common businesses that require no upfront investment to get started:

Dropshipping

Dropshipping is when you act as an intermediary between customers and a supplier without first purchasing or keeping inventory yourself. By building an online storefront, you can offer items to your customers that your supplier has agreed to provide to you at a wholesale price.

Photography

Photography is a growing field and there are many people and places who will want your services. Weddings, birthdays, concerts and corporate events all often involve a paid photographer. If you already own a camera and possess some basic photography knowledge, it can be easy to start your photography business.

Pet sitting

Pet sitting and house sitting only require your time and attention. While certification isn’t required, pet owners and homeowners alike may want to hear about any prior experience you have providing care for pets.

The main qualifications for pet sitting are loving animals and being responsible. You can join a company that already provides pet services, find an online community that caters to pet sitting or build your own brand as an individual.

Personal training

Providing personal training or fitness coaching does not require a degree or certification, and by making your services available digitally, you don’t need to pay to rent a space or equipment. The bulk of training income comes from one-on-one workout sessions, which can be done remotely or by selling fitness plans online. If you find a place to monetize video content, you can also leverage tutorials and workouts.

Freelancing

There are a whole host of services that you can provide as a freelance worker. If you enjoy writing, you can find work designing courses, developing social media captions, writing articles and supporting many other kinds of publications. The same goes for any other marketable skills like graphic design or even project management.

2. Create a business plan

A great business plan will prepare you for successes and failures by outlining your entire business from top to bottom. Potential investors will want to see your business plan, so they know they are making a wise investment with a good chance of returns.

Make your business plan successful by being straightforward, easy to understand, using clear charts and visuals and using industry-specific research. It is important to include:

- An executive summary: This provides a big-picture look at your business plan, including organizational structure, product or offerings, marketing strategy and financial projections. Make sure to also include a mission statement for your new business.

- Market analysis: Conducting a competitive analysis will help you review what other similar businesses are doing to be successful. Look for trends and themes that you can follow as well as opportunities to improve your product or offering. In addition, look for gaps in industry offerings that you may be able to fill.

- Customer profiles: Outline the key demographic you will target and how your products or services will uniquely meet their needs, including the competitive advantage you will offer them and how you will reach them.

- Company structure: Describe how your company will be structured and who will run the business. Include an organizational chart to show how every new member will contribute to the business. Include information on your leadership team’s qualifications. Identify if your company will be an LLC , a partnership or a type of corporation. Learn more about business structures here .

- Financial projections: Including financial projections for your business will help convince investors that your business will be successful. Forecast how your business will perform over the next five years, with specific breakdowns at the quarterly or even monthly level for your first year. This is a good place to use clear charts and graphs to effectively share the research you’ve done.

- Supporting documentation: Include resumes for your key employees, analytics reports and patent or trademark documentation and product images to support the claims you’ve made in your business plan.

3. Seek funding

If you have a business idea but need capital to get started, you’ll want to seek funding from other sources. Every business has different needs, so first, determine exactly how much funding you need. Once you have a fundraising goal, you can determine which sources are best to pursue.

- Self-funding: Sometimes referred to as ‘bootstrapping,’ self-funding can refer to money or loans you get from friends and family, your own savings reserves or even withdrawing from accounts like a 401(k). While this gives you the most control over your business and earnings, it’s also risky. Often, you must pay these types of funds back with little guarantee you can.

- Venture capital: Investors provide venture capital funding in exchange for a stake or role in the company. Some may want an executive position, a seat on the board or other involvement in your business. Venture investments typically apply in rounds and are subject to change based on the success of the company.

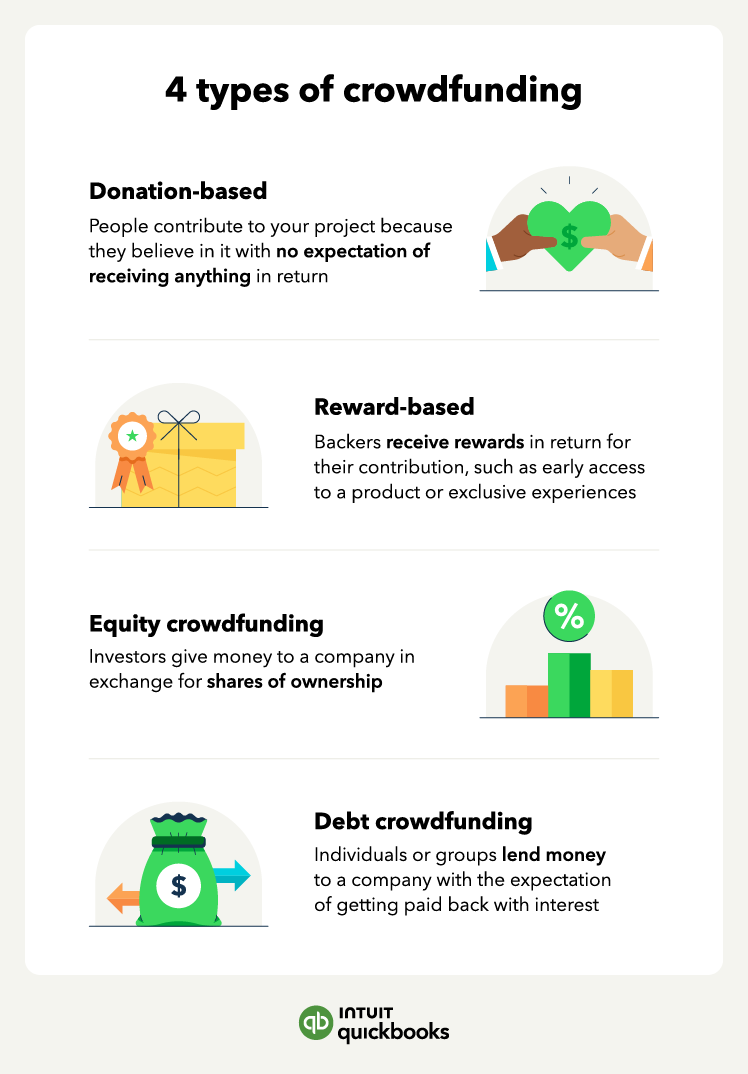

- Crowdfunding: You can appeal to potential customers who would like to support your business by launching a crowdfunding campaign. Each crowdfunding platform has specific rules and takes different percentages of what you raise, so make sure to read the terms carefully. Donors will expect something in exchange for their money, usually a prototype of your product or some other kind of gift.

- Small business loan: Connect with banks and credit unions to begin the process of applying for a small business loan. By applying for your loan with multiple financial institutions, you can compare rates and offers to find the best loan for your business. A lender will expect to see a business plan, an expense sheet and your financial projections.

- Small business administration (SBA)-guaranteed loan: If financial institutions are worried about the risk associated with your fledgling business and you do not qualify for a traditional loan, look into SBA-guaranteed loans instead. Learn more about SBA-guaranteed loans here .

4. Define and build your brand

Market research can help you identify what similar businesses are doing in your industry, but now it’s time to use that knowledge to differentiate what you do. Your business’s brand encompasses everything from what colors you use in design and advertising to what values you think are important to your day-to-day practice.

Once you’ve reviewed the brands of competitors, you should sit down and think about what you want your brand to be. For example: Is it cool and hip? Reliable and safe? Low-waste and environmentally conscious?

Whatever you want your brand to be, make sure to take the following factors into consideration:

- Name: Your brand name is very important. It should give customers a sense of what you do and how you want them to feel about what you do. It should also be distinct from your competitors and easy to spell and remember.

- Audience: Know who your potential customers are and make sure you’re speaking to them. For example, if you’re targeting older customers, you shouldn’t use popular slang in your messaging.

- Purpose: Defining your purpose not only provides clarity to your customers but also to yourself and any employees. Answer why you do what you do and what is important about your product or offering.

- Voice: Brand voice is how you talk about your brand. Do you want to brag about how good your services are? Do you want to back your product with lots of research? Finding your voice helps support the other factors you’ve already defined for your brand — including your audience and purpose. Create a style guide that outlines your company voice, including what and how you communicate to customers and how you do not.

- Look: Likely the first thing you think of when you imagine a brand is how it looks. From what kind of colors a brand uses to its logo to its font choices, a visual brand is an incredibly important part of how customers associate your product with your business. Create a style guide that defines your brand’s color scheme, logo usage and graphics templates, for example.

5. Test your business idea

Once you’ve written your business plan, secured funding and defined your brand, it can be tempting to open your business up to the world. But before you do, try a smaller-scale launch that allows you to test your processes and offerings.

Start local or build a simpler version of your product to troubleshoot for any roadblocks before moving into production. Be sure to survey customers during your testing period to see how they feel about your offerings and your brand. Don’t forget to ask about your customer service and overall experience.

Positive signs it might work

If people are excited about your offerings and want to know more, that’s a good sign. Carefully review the feedback you’ve gotten from friends, family and customers during your test launch. If you can, connect with other experts in the industry. As you evaluate the success of your soft launch, ask yourself:

- Have I improved an existing product or offering?

- Did I successfully solve a problem?

- Is my business sustainable?

- How many people can afford to purchase my product?

- How can I better speak to the needs of my customers?

The answers to these questions will help you envision the future success of your business, and will determine what changes you still may need to make for a successful final launch.

Scaling the idea in the real world

Once you’re ready to grow your business, you’ll need to strategize how to maximize your sales while minimizing your costs. Reflect on your test launch to better understand your customers and their needs.

Common scaling mistakes include:

- Scaling too quickly.

- Prioritizing short-term goals over long-term goals.

- Overlooking the efficacy of your processes and systems.

While growth focuses on increasing revenue, scaling focuses on making your business agile and efficient. It requires looking internally at your business as much as it does looking outward at your customers. To do so, think about tools that can help you scale, including:

- Payroll software .

- Recruiting and onboarding software .

- Project management software .

- Task management software .

- Payment processing software .

- Customer relationship management software .

Most of these types of software have free versions available for budget-conscious businesses. Many also offer free trials to help companies get started with no startup costs.

Persisting through adversity

There will be roadblocks the work through as your business grows, but they can be overcome. Common mistakes in small businesses are:

- Failing to properly price services or products.

- Not asking for help.

- Being too optimistic when setting goals.

- Misunderstanding potential customers.

If you encounter any of these challenges, don’t give up. Try performing a SWOT analysis to identify your business’s strengths, weaknesses, opportunities and threats.

Then set SMART goals that are specific, measurable, achievable, relevant and time-bound. Once you’ve analyzed your challenges and set new goals, you’re ready to move forward.

6. Market and grow your business

Once you’ve established your business, identified your customers, evaluated your processes and needed tools to successfully scale and prepared to adapt to challenges, you’re ready to grow.

There are many different ways that you can market your business, reach new customers and improve brand recognition. Grow your new business with the following marketing ideas:

- Get listed: Set up your business details on Google so that customers can easily find your website, hours and other pertinent details.

- Go social: Determine which social media platforms are most popular for your target customers and establish a presence there.

- Get involved: Make sure to engage with any relevant online communities where you can become a subject matter expert by sharing on relevant topics and sharing your business’s offerings.

- Provide expertise: Expand your reach by going out into the community in person. Attend relevant trade shows or offer your expertise in webinars and workshops.

Frequently asked questions (FAQs)

Yes, you can start a business with no money, but it often requires you to find funding elsewhere. Businesses that have no start-up costs will eventually cost money in order to grow, including advertising, market research or building a website.

The cheapest businesses to start require no start-up costs and depend wholly on services or products you can provide as an individual, including freelance writing, dropshipping, personal training, pet sitting or other personal skills like photography, design or working as a personal assistant.

To start a business, you need a solid business idea. Start with market research before finalizing your idea. Use that research to develop a business plan that will help you find funding, choose a business structure and prepare to launch.

Finally, you’ll need a business name and the necessary licenses and permits to legally register your business.

Blueprint is an independent publisher and comparison service, not an investment advisor. The information provided is for educational purposes only and we encourage you to seek personalized advice from qualified professionals regarding specific financial or medical decisions. Individual results may vary. Past performance is not indicative of future results.

Blueprint has an advertiser disclosure policy . The opinions, analyses, reviews or recommendations expressed in this article are those of the Blueprint editorial staff alone. Blueprint adheres to strict editorial integrity standards. The information is accurate as of the publish date, but always check the provider’s website for the most current information.

Cat McAlpine is a writer and marketer based in Columbus, OH. She uses her expertise to support small businesses and arts organizations in her city.

Sierra Campbell is the lead small business editor for USA TODAY Blueprint. She has been featured on USA TODAY Blueprint and U.S. News & World Report as a writer and an editor. She has also contributed to publications like ConsumerAffairs. She has experience with many B2B and B2C categories. Sierra previously worked as an editor for U.S. News & World Report, where she focused on subjects such as credit card processing, business phone systems, web hosting, home security systems and moving companies. She also worked as a digital content producer and show producer at several local TV stations across the nation. In her free time, Sierra runs her book editing business, Editing by Sierra, LLC. She offers developmental editing, copy editing, line editing proofreading and simple formatting services to self-published and traditionally published authors.

7 Steps to Successfully Start a Business With No Money

Karoki Githure

12 min. read

Updated June 7, 2024

Are you the type of entrepreneur who has big ideas and the drive to bring them to life, but feels held back by a lack of funds?

Many people just like you dream of getting into the world of self-employment by owning their own business.

Unfortunately, some people end up completely putting off their ambitions. The pressure to quickly generate revenue to cover startup costs — or get outside financing like a bank loan — can feel overwhelming.

But is it really impossible to launch a business without any startup capital? The answer might surprise you.

Can I start a business with no money?

Yes, you can start a business with no money. You just need to be strategic and patient in your approach. Here are a few things you should do before you dive into the startup process .

Keep your job

Sure, your idea is exciting. Don’t get carried away. Immediately quitting your job and registering a sole proprietorship is about as risky as it gets.

So start slow. Best to run the business as a side hustle in these early days, whether that’s after work or on weekends. You should also be realistic about the commitment required. Going on the path to starting a business will require making compromises in other areas of your life as you balance this new venture with your day job.

Your job will ensure your livelihood isn’t relying on the success of your business. Besides, you can save your business’s profits to fund costs that might arise as the business grows. Keep doing what you’ve been doing for a living with the aim of working hard and smart on your business. You can decide to leave your job when the startup can pay you .

Read more: The 10 best side hustles to fund your startup

Tap into free resources

Whether you need to fully outline your business structure , write a business plan , create a marketing plan , research licenses and permits , or even register your business—there’s likely a free template, tool, or article out there for you to check out.

You can also use free trials for paid business tools. This will give you an idea of the overall functionality and help you determine if it’s worth eventually investing in.

Downloads: Bplans free business resources

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

Network, network, network

Sometimes it really is about who you know. If you’re starting a business with limited resources, consider how you invest your time. Forging networks by interacting with people in your industry is a great way to learn from entrepreneurs on the same journey as you.

Even if your concept is unique, it’s still worth networking with other entrepreneurs. Talking to people who have been down a similar road will help you learn what it takes to run a successful startup.

Seminars and webinars, events, conferences, social media groups and online forums can also play a huge role. Connecting with a local SCORE affiliate or Small Business Development Center can keep you updated on workshops and events near you. Even Reddit groups for entrepreneurs and small business owners (known as subreddits) can provide a ton of free knowledge from entrepreneurs who have walked in your footsteps.

- How to start a small business with no money

You’re likely still asking yourself, “So how can I start my business with no money?” Work through this seven-step process to go from idea to full-fledged business with little to no funding.

1. Identify your business idea

The foundation of a business is based on strong ideas. So It’s only natural that identifying your business idea is the first milestone in your entrepreneurial journey. Start by brainstorming and writing down your potential options. Pay attention to how you can be of service to customers by offering a solution that doesn’t currently exist or is better than existing options.

Analyze the ideas you have. How passionate are you about them? What talents do you have? Would your skillset make it successful?

Is there anything your family, friends, or colleagues say you’re good at or come to you when facing a particular problem? Narrow down to the one that stands out and catches your interest.

Below are some pointers that can help you find your business idea:

- Examine your marketable skills or experience that can be turned into a business.

- Analyze existing businesses’ unmet customer needs so and identify opportunities to fill the gap.

- Is there a product/service that you wish existed?

- Look at existing products and services think about how to improve or add value to them

- Investigate other markets to see whether your products/services are needed there.

Idea generation is also one of the areas where AI tools like ChatGPT and the LivePlan AI Assistant really shine. If you’ve got some ideas written down, try feeding them into an AI tool and see what it provides as an output.

Just remember, it’s your job as an entrepreneur to sort through those outputs and separate any good ideas from bad ones. AI is a collaborator, not a replacement for your own ideas.

Read more: 17 ChatGPT prompts you can use for starting a business in 2024

2. Conduct market research

Understanding the market is crucial to determine your business idea’s potential in the real world. So once you have an idea, start conducting thorough market research on the industry your business idea aligns with. This will give you an idea of the overall market landscape and how your business might perform.

Identify your potential competitors and what they’re doing. Your main aim is to determine whether you have a more innovative, better, and cost-effective way of doing things. By studying your competition, you’ll find out whose business idea has holes. You can also figure out a unique value proposition for your business.

Research your potential customers as well. Understand their occupations, age, education levels, and locations. Study their current buying habits and whether they’re willing to pay more for better quality products/services.

This is an area where AI is less helpful than idea generation. It frequently gets facts wrong. Say you’ve noticed that many seniors in your small town lack access to services, so you plan to start a grocery and prescription delivery business in your small town. AI doesn’t understand the unique market dynamics of your geographic area, so any information it gives you is unlikely to be helpful — it may even make up information.

You’re better off reading through online reviews of similar types of businesses or surveying people in social media groups. Post a questionnaire in the groups your potential customers have joined.

Talking directly to potential customers can shed light on areas where their needs aren’t fulfilled. The information you gather will help you understand your target customers’ types of purchasing habits, needs, and preferences.

3. Create an MVP and test your idea

Whether you’re selling a product or service, testing the idea with no cost or the least cost possible is advisable. A minimum viable product (MVP) is a bare bones version of a new product with core features to test its viability in the market. The purpose of an MVP is to see the early customers’ experience with the product and use the feedback in further developments.

You can create a website for your product/service and check website metrics. Use low-cost or free websites and web analytics tools available. Include an option for email signups/preorders for more information to gauge their interest. Track basic metrics like:

- Website session duration

- Traffic source

- Number of visitors

- Average time on page

You should also tap into the power of social media . Create a post, page, or short video about your product or service, share it on social platforms, and see how many people are interested. Their interactions, comments, views, shares and reactions should give you some indication about how your idea is being received.

Another way to get this feedback is to conduct a crowdfunding campaign . If they’re interested in investing after using the product/service, then that’s a good indication that the business idea is worth pursuing. Even if you don’t get the funding, their feedback will guide you on which areas to improve.

You can also do it the old-fashioned way and offer your services in your neighborhood for free. Set up in a public area where you expect your ideal customers to congregate, inform them about your business and ask for their honest review of your performance.

Keep in mind that your intent is to determine whether the idea is viable or not. If things don’t go as you had hoped, use the feedback to reflect on what areas to improve on, or if the idea isn’t worth pursuing at that time.

4. Develop a plan

You’ve learned a lot about what you’re getting into by this stage. Based on the information you’ve gathered, it’s time to outline your business’s current and future goals. You need to have a business plan to organize the direction of your business.

If you don’t know how to write a business plan , use this free online template . Bear in mind that it will be your resource in starting the business. So make sure it’s a short and actionable plan. However, include your statement of business operation , product/service description , and market analysis.

A good business plan also helps you set short-term and long-term goals as well as eventual startup costs . It will be a roadmap for your next steps, help you keep expenses low and decide whether to invest more capital or pursue funding .

5. Set up a payment method

Be ready to receive payments any time an opportunity arises. You don’t want someone to agree on buying your product or service, only to lose them because you haven’t figured out how they should pay you. So determine how you’ll receive payment and set those systems up before becoming operational.

When deciding which methods to use, compare their price, features, flexibility, security, and functionality. If you’re running an ecommerce business, you’ll want to read reviews of online payment systems and apps.

The best fit for your business depends on several factors such as the size of your transactions, popularity, customers’ preference, and age, among others.

6. Focus on organic communication

Another critical aspect of starting a business with no money is spreading the word about your product or service to your customers. You’re obviously not trying to invest a ridiculous amount of money in your marketing efforts. So it’s best to focus on organic options as part of your initial marketing strategy .

Create a website

Launch a website for your business and utilize free SEO tools to research the most valuable keywords in your industry. Use your results to create search-optimized pages that describe your product or service, provide an overview of your reason for starting the business, answer frequently asked questions, and provide sales and contact information. Putting your physical address on the contact page is a good way to rank in search engine results when someone conducts a regional search.

Make sure your website has a blog section where you publish optimized content regularly. Take advantage of free content marketing courses to hone your skills. Similarly, free digital marketing courses can teach you which method works depending on the business.

Tap into social media

From Instagram to TikTok to LinkedIn, social media is everywhere. So you should take advantage of these (mostly) free tools to create social media pages that showcase your business.

Use social media posts to drive traffic to your website or online shop. Respond to the comments written by your customers , and participate in social groups or forums. This is a great way to start building an audience and engagement naturally. Just keep in mind that it will take time and effort to maintain.

You should also prioritize the social media channels most likely to resonate with your customers. For example, Instagram is a better tool than LinkedIn for clothes designers since it’s more suitable for sharing photos.

Read more: Got a bad customer review? Here’s what to do next

7. Explore funding options

If your business reaches the point where you need funding or extra capital for growth, it’s time to explore your funding options . If you have enough savings, you can inject that into your business. However, if that’s not the case, consider other funding options.

The most traditional and obvious option for small business owners is to apply for a bank loan . However, it’s also worth exploring grants from federal, state, or regional agencies. There may even be private grant options from larger organizations. These are typically grant programs that cater to specific demographics such as minorities, veterans, and other underrepresented small business owners.

Not interested in traditional funding? Leverage crowdfunding sites to raise funds in exchange for the product/service, debt, or the purchase of small shares in the idea. The ideal stage for crowdfunding can be the testing phase.

Friends and family are a common source of financing too. However, be professional and agree on a payment plan to avoid ruining your relationship.

If you’re in more of a startup environment, angel investors and venture capitalists may be your best option. These are primarily used by businesses looking for quick funding in exchange for ownership equity, royalty payment, or convertible debt.

From starting to growing your business

The amount of starting capital doesn’t determine the success of a business idea. In the initial stages of executing your business idea, it’s best to stay lean and avoid unnecessary expenses. However, as the business grows, there comes the point where that can’t be done anymore.

Planning for this moment will help ensure that your idea doesn’t run into a cash flow crisis — something that can happen even to businesses that are popular and generating revenue.

If you’re prepared to do what it takes to ensure your business runs smoothly, you’re on the right track. And if you’re committed to starting a business with no money, download our one-page business plan template to quickly start creating your own business plan.

Karoki is a freelance content writer and blogger with experience writing about entrepreneurship, business, freelancing, and self-development. Apart from writing, he loves a little bit of adventure and creating beats/instrumentals on his digital audio workstation (DAW).

Table of Contents

- Can I start a business with no money?

- From starting to growing your business

Related Articles

7 Min. Read

6 Reasons Why Small Businesses Fail and How to Avoid Them

3 Min. Read

5 Keys to Keeping Your New Business on Track

4 Min. Read

Is It Too Late to Start a Business?

9 Min. Read

How to Start a Business From Scratch in 6 Easy Steps

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

30 businesses to start with little money

You can definitely start a business with little cost or even no money upfront. For most, it’ll likely be a service business since you won’t want to worry about managing inventory. For these, you’ll just need a website, some hustle and creativity.

Starting your own business is a great way to control your own time, make some extra cash with a side hustle, and even have a chance at turning your hobby into a successful business. So as you go through this list of business ideas consider your existing skill set and personal interests to find the small business idea that fits you best.

Here are some of the best low cost businesses you can start with no money or very little money.

1. Concierge business

What you’ll need: Website, business cards, transportation.

If you live in an affluent area or neighbor to one, you would be amazed at what some people are willing to pay to not have to do boring chores themselves.

From grocery shopping to dry cleaning runs to handling travel booking and scheduling doctor’s appointments, you can become a personal assistant. Someone who is super busy and finds their time too valuable for these more mundane tasks would gladly pay for this concierge-level of service. That’s where you come in.

You may need some connections or some recommendations to get started. Then, you can build a successful concierge business by being reliable, trustworthy and fast.

2. Auto detailing business

What you’ll need: Vacuum, cleaning supplies, power/water supply, transportation.

You’ve likely seen the TikTok videos about this one. With a vacuum cleaner you may already own and a few cheap bottles of automotive cleaning products, you can offer to come to anyone’s home or work and make their car’s interior look like new.

You’ll need to commit your time and be willing to get a little dirty but you can get started with minimal startup costs, then look to expand if it’s something you find you like doing (and is profitable).

3. Consulting or coaching business

What you’ll need: Something to manage clients, a personal expertise to share.

If you’re an expert in a particular field, you can start your own consulting business. Depending on what you’re consulting in (financial, legal, cybersecurity), this can be among the most profitable small business ideas .

If you have marketing experience, you could help entrepreneurs grow their small businesses while growing your own. And, on the other end, there’s coaching. If you played minor league baseball, look into coaching kids on how to clear their hips when they swing. These go hand-in-hand as they both involve sharing some degree of expertise.

All you need is a form of contact, possibly a website (which you can set up for free) and some level of marketing to get the news out there about your service. You’ll want to share why potential customers should trust you as an expert worth paying.

4. Podcasting

What you’ll need: Microphone, recording and editing software.

Starting a podcast can be a great way to build an audience and earn some extra online income . You’ll need a microphone and some recording software. In most cases, you can get started with just a few hundred dollars if you’d like a more professional set-up than just the mic that comes with your computer.

Once you’ve recorded a few episodes, you can look into submitting your podcast to iTunes and other directories for free. Those who have something they enjoy talking about, such as fantasy football or the adventures of cooking, might find this to be the perfect option. Even better if it’s a podcast you can commit to with friends.

Success rate can be low as building an audience versus existing competition is challenging but positive endeavors can attract sponsorships and even donations.

5. Local tour guide

What you’ll need: Local familiarity, promotional materials and possibly a tour guide license.

If you live in a tourist-friendly area, why not become a local tour guide? You can create your own walking tour or offer guided bicycle tours. All you need is some knowledge of the area, a few promotional materials (which you can create yourself for free) and possibly a tour guide license depending on your area.

That’s how the famed Scott’s Pizza Tours started out based on their familiarity with the NYC area and love of pizza. They now have grown to offer walking tours, bus tours and even online classes all about pizza. Approach some businesses for potential partnerships and let them know you’re thinking about using them as a stop to make it beneficial for all involved.

6. Bookkeeping

What you’ll need: Business accounting software, client management software, certification (optional).

Bookkeeping and accounting is perhaps one of the most in-demand services that small businesses will farm out to part-time contractors. And you don’t need to be a CPA to keep a company’s books — most of this work is routine data entry and management of bills.

You can find evening or online training for bookkeeping pretty easily if you have no experience and even certify with the American Institute of Professional Bookkeepers (AIPB) .

7. Dog walking or pet sitting business

What you’ll need: Website or some ads to share, CPR and first-aid certification.

If you love animals, there are plenty of people who will pay you to do some pet sitting for a few hours. Depending on your schedule, this could be a part-time way to make money while you’re in college or a very full-time gig. You could probably start working without spending a dime.

Pet sitting can sometimes mean having a dog stay at your house, or staying in the house of a stranger or family member while they are out of town. For even less commitment, consider dog walking business. You can charge $20 or even more depending on your area for a 20 or 30 minute walk. Or do both! Offering both services could turn into a lucrative business. Some dog walkers have worked up to hustle to $100k a year without a college degree!

Check out sites like Care for pet care and Rover for sitting/walking, but like with any job websites, be wary of scams. It’s also highly recommended to know the life-saving techniques specifically designed for dogs. There’s CPR and first aid courses specifically for dogs for you to receive certification in.

8. Window washing business

What you’ll need: Flyers, window washing cleaning supplies and possibly transportation depending on where you live.

This is a great business idea if you’re handy and don’t mind working outdoors. You’ll need some supplies, some of which you’ll already have (ladders, buckets, rags, etc.), but the total investment shouldn’t be more than a few hundred dollars.

To get started, walk around and ask local businesses if they need their windows washed. If you’re in a city there will be plenty of potential but you might need a car out in the suburbs. After a few jobs done, ask past customers if you can post non-obtrusive flyers. You can also promote your business online and through various social media on the local level.

9. House sitting business

What you’ll need: Quality references would help.

This is a great way to make some extra money if you’re responsible and trustworthy. Homeowners (even those without the furry friends we mentioned) would have some peace of mind if someone was watching their house while they’re out of town for an extended period of time. All you need to do is take care of the property, like maybe water the plants, and follow their instructions, like setting the security alarm.

To get started, create a profile on matching services like Trusted Housesitters or Mind My House and start applying for jobs. You may even have friends and family reach out for when they’ll be out of town.

10. House cleaning business

What you’ll need: Cleaning supplies, transportation and possibly state licensing.

Think about all the people in your neighborhood who work long hours and don’t have time to clean their houses. If they’re not using a cleaning service already, they may need someone reliable who’s local to clean their house once a week or month.

Starting a house cleaning business is a great way to get started in the business world with very little overhead costs or commitment. All you need is a vacuum cleaner, mop, and some other basic cleaning supplies. You’ll make more working individual jobs for a set fee than working for a company that pays hourly.

11. Home painting business

What you’ll need: Painting supplies, transportation.

A home painting business is another low-cost option for entrepreneurs with some minor experience to be their own boss. To get started, all you need is some basic painting supplies and a vehicle to transport them to the home you’re painting.

Once you’ve built up a reputation for quality workmanship, you may want to consider investing in ladders and other equipment to help with larger jobs.

12. Landscaping or lawncare business

What you’ll need: Website, transportation, plus supplies like a lawnmower, edger and weed eater.

With a lawncare or landscaping business, the sky’s the limit in terms of potential earnings. To get started, all you need is some basic lawn care equipment like a lawnmower, edger, and weed whacker. That’s why it’s one of the highest paying summer jobs for college students that can end up becoming a long-term career once the potential’s uncovered.

As your business grows, you may want to invest in additional equipment like a truck or trailer to bring in equipment or haul away debris. If your clients want any particular landscaping done, they can foot the bill for any plants or vegetation.

13. Snow removal business

What you’ll need: Website, reliable transportation, shovel, snow blower, salt sprayer.

Snow removal is a low cost business idea for entrepreneurs who live in snowy climates. To get started, all you may need is a basic shovel. You can walk around city sidewalks and offer to shovel for businesses. As you grow, or if you live in the suburbs where it falls heavy, a snow blower, and salt spreader would be great tools. You may also want to invest in some good cold weather gear so that you can work comfortably in the winter months.

If you get busy enough you can invest in a plow for your truck and increase your client base, perhaps handling the clearing out of parking lots.

This is a great business to pair with a landscaping business as they’re seasonal small businesses. In the warmer months, you could offer secondary services, such as lawn maintenance or handy work, to your existing clientele that you removed snow for.

14. Delivery service business

What you’ll need: Transportation and commercial car insurance.

You’ve probably heard of some of the best food delivery apps , like Ubereats and Grubhub, but there are plenty of other opportunities as well. For example, apps like Roadie and GrabMyBag take luggage from the airport and deliver it to the customer – either because the bag was lost or for customer convivence when flying. There’s also Instacart and whole list of jobs like Instacart to make money.

Many businesses also need professional courier services. Real estate companies, lawyers, hospitals and more use couriers to move important papers and other items from one place to another. If you have a truck or van, you can start your own small delivery service business relatively easily and cheaply after getting the necessary insurance.

15. Catering, baking or personal chef business

What you’ll need: Website or social media like Instagram, kitchen supplies, permits, commercial kitchen space (optional).

If you love cooking, why not turn your passion into a profit? A catering service for parties or personal chef business for a private client is a great way for foodies to make some extra money on the side (or even turn it into a full-time job). If you’re an excellent baker, consider selling your baked goods on social media or getting started at local markets by renting a table.

To get started with these, all you need are some basic kitchen supplies. As your business grows, you can consider moving into a commercial space to help with food preparation or hiring staff.

If you do have some funds right now and like the food industry, a food truck can be an option as a business you can start with less than $20k . With proper research on licenses and permits for starting a food truck, you can look at setting up at places like concerts and sporting events to sell your food.

16. Senior transportation business

What you’ll need: Website, transportation, insurance.

As the population ages, there will be an increasing demand for transportation services that cater to senior citizens who can no longer drive themselves around town or take public transportation.

If you have a car or van that can accommodate wheelchairs or walkers, then you’re already a step-ahead. In addition to the vehicle cost, you will also need insurance.

17. Online store

What you’ll need: Website, account on an eCommerce platform, inventory, shipping supplies.

With the rise of eCommerce, starting your own online store is easier than ever before. There are several platforms you can use to set up your store (such as Shopify, Etsy, Amazon, eBay, etc.), and many of them offer free trials or have no to low monthly fees depending on your level of selling.

You will also need to invest in some inventory (if you’re not selling digital products, like NFTs), but other than that, the startup costs for an online store can be quite low.

18. Freelance business

What you’ll need: Website or other internet profile, accessible portfolio of work (maybe).

If you have a skill that others are willing to pay for (such as writer, editing, graphic design, web development, etc.), then starting a freelance business could be a great way to earn some extra cash.

The best part about freelancing is that you can work from home or anywhere in the world and most than likely set your own hours. All you essentially need to start is a laptop and an internet connection!

Although there are no startup costs per se, you will need to invest some time in marketing your services and finding clients. Starting small, building clientele and sharing an accessible way for clients to view your past work and positive reviews can make this into a lucrative small business idea.

» MORE: Making the decision to earn more money

19. Fact-checking or researching business

What you’ll need: Website or profile, like on LinkedIn, and a computer.

Did you know that nearly every major magazine and many websites obsessively check and recheck every fact and source in their story? Even more so if they’re advertising a service or product.

Best of all, very few employ in-house researchers to do this critical task, sometimes even contracting it out (to your potential benefit). Yes, it’s tedious, but it only requires a device that connects to the internet and the ability to focus on the verification process.

20. Association manager

What you’ll need: Website, client management software.

Every day, people form new professional networks, community associations, or groups of like-minded hobbyists. The only problem is groups like these take a lot of administrative work to maintain.

There are websites to build and update, newsletters to write, dues to collect, meetings and events to schedule, and mailing lists to maintain. Think you’re up to the task? By creating templates and shared protocols, you could easily begin managing several groups and start raking in the dough.

21. Property manager

What you’ll need: Website, phone, software for handling maintenance and service requests, real estate license (maybe).

The grown-up version of classic teenage jobs like shoveling snow and mowing lawns, property managers help small to medium-sized landlords everywhere take care of their real estate. The responsibilities can vary, from simply taking calls from tenants and arranging for maintenance to handling the fixing and landscaping yourself. Property managers are also a frequent need for Airbnb owners, letting you make money off Airbnb without owning property.

If you want to go full-service, you can even offer to show apartments, screen tenants, and collect the rent, but you may need a real estate license for certain aspects.

If you enjoy doing handyman work around the house and you’re reliable, then starting your own property management business might be a great business idea.

22. Freelance writer

What you’ll need: Website, some way to share prior work or expertise

Expanding on Freelance business above, there is a huge variety in the world of freelance writing exclusively so if you like to write you can likely find clients in an area that is of interest to you.

There are a lot of different types of writing jobs available including, books, articles, sales pages, social media posts, and product descriptions. Most businesses need some kind of writing done that they can’t have done in-house and most of those jobs are contracted out to freelancers.

23. Garage sale flipper

What you’ll need: Selling platform, transportation, space to store inventory

This is definitely not one of the most traditional businesses out there — but re-selling can be surprisingly profitable! If you enjoy hunting and negotiating for good deals and have ample storage space in your home, flipping items from garage sales, estate sales or flea markets like could be a great way to make some extra income (or even find it so lucrative to become a full-time endeavor). You can end up selling an assortment of finds like video games, vintage clothing, tupperware, sports cards and Pokemon cards for extra cash .

You will need some money upfront to buy the item and any necessary supplies to flip it. You’ll also likely need a car to get to most sales and transport items from sales if you have any finds. The only other dedicated investment for this type of business is time — you’ll need to dedicate some hours each week to scouring garage sales and flea markets for potential items to flip. But all in all, this can be a very low-cost and fun small business venture or side gig!

24. Online blogs, courses, or memberships

What you’ll need: Website or other platform to share content.

If you’ve got something you love to write about, you can definitely earn use that as a side hustle to earn extra money — or even launch a full-time business — on the internet. Although I went the blogging route, it’s getting increasingly difficult to just throw up a blog and start collecting advertising checks. Today’s online entrepreneurs are finding faster (and bigger) success by creating smaller amounts of premium material and charging for that content as a course, ebook, newsletter or membership site.

I strongly recommend Ramit Sethi’s courses. At least check out his free guide, 30 Successful Online Business Ideas , and start brainstorming what you might be able to accomplish.

25. Personal stylist

What you’ll need: Transportation, website or social media and possibly liability insurance.

A personal stylist business is a great idea if you love fashion and helping others (and have a knack for it). The only real cost you would need to cover to start this business is any transportation costs to get to and from your clients, such as your own car or Uber fare.

Ideally, your clients will pay a deposit upfront for any clothing or beauty items you buy for them as part of your recommendations. Consider professional liability insurance that protects stylists from lawsuits brought by dissatisfied customers.

26. Event planner or wedding planner

What you’ll need: Website, social media, planner certification (optional).

If you love planning events and have experience making things beautiful, then starting an event planning business might be the perfect business for you. Share past events you’ve helped with on Instagram and other social media to generate buzz.

To start this business, you’ll need to cover the cost of marketing (e.g., creating a website, printed materials, etc.), as well as any fees associated with becoming certified as a wedding planner to help you stand out from the competition.

27. Interior decorating or home staging business

What you’ll need: Website, transportation, furniture (maybe).

Do you have an eye for design? If so, then starting an interior decorating or home staging business could be perfect for you. To get started in this business, you’ll need to cover the cost of marketing (e.g., creating a website) and any design software you need to make your clients’ dreams come to life.

That said, if you go with home staging over interior decorating, there may be added startup expenses as you’ll most likely be “renting” the furniture to your client. But if your primary focus is interior decorating, your clients will pay for any items you recommend they would like.

28. Tutoring business

What you’ll need: Website, quiet place to work.

Do you love helping people learn? A tutoring business is a great way to make some extra money while helping others towards their success. All you need to get started is a knowledge of the subject you want to tutor in, like math, and a quiet space where you can work with students.

A tutoring business can be run from your home or the home of the student you’re tutoring (or a common place, like a library), so there’s no need to rent office space or buy expensive equipment. Those looking for travel-friendly work opportunities can also look into tutoring online.

29. Resume writing business

What you’ll need: Website, portfolio of samples.

Are you good at writing resumes? Believe it or not, there is actually quite a demand for professional resume writers, especially if you can provide a quick turnaround for those in need. Job seekers need a powerful resume with a human touch that can pass the AI checkers and catch a hiring manager’s eye as they sift through piles of resumes.

To get started in this business, you won’t need much. A website and documentation proving you’re good at what you do (e.g., samples of your work) works as a jumping off point. Then work on networking and connecting to those who can benefit from the service.

30. Personal training business

What you’ll need: Website or other social media, gym partnership (optional).

If you enjoy working out and it visually shows, then becoming a personal trainer is a great business idea with very low startup costs. You can run group sessions or have individual one-on-one training sessions with clients in public spaces or online.

Focus on workouts and session types you can do outside a paid gym to keep costs down for both you and your clients. You can also look for clients that will have their own equipment or personal home gyms that just require the guidance you can provide.

Tips for starting and managing a small business

Consider drafting a small business plan to get started so you have your own guide on how to proceed and budget to hit your goals . It is also a good idea to connect with other business owners for useful tips on how to run and grow your business. It’s always nice to have support of other business owners who have been through similar issues you’ll face if you’re able to get it when launching your own business.

And, if your small business takes off and you would like to separate your finances to help keep track, consider a choice from some of the best business checking accounts . Some immediate benefits include protection and convenient ways to receive payments without mixing finances, creating headaches down the line.

» MORE: Why you need a bank account for your business

Small business legal requirements and protections

When starting your own small business look into the legal requirements in your area. Some states require a business license or registration of some sort depending on the business.

Also, contact an insurance agent and make sure that you are covered legally. You may want to consider liability insurance or errors and omissions insurance. Also, if you enter people’s homes you may need a bond – which covers you in case you are accused of theft. You may also need commercial car insurance if you driving as your business or side gig. You can also consider forming an LLC for your small business for some legal protection.

If you have no or little money right now, you may need one of these easy small business ideas and advice on starting a business with no money. With some creativity and resourcefulness, there’s no reason why you can’t turn your dream of a small business or ideas for a side hustle into reality — even if you’re just working with a small amount.

- Starting a Business The tools and resources you need to get your new business idea off the ground.

- Payments Everything you need to start accepting payments for your business.

- Funding & Capital Resources to help you fund your small business.

- Small Business Stories Celebrating the stories and successes of real small business owners.

- Self-Employed The tools and resources you need to run your own business with confidence.

How to start a business from scratch: 19 steps to help you succeed

Free business plan template and how to fill it out

- Running a Business The tools and resources you need to run your business successfully.

- Accounting Accounting and bookkeeping basics you need to run and grow your business.

- Cash Flow Tax and bookkeeping basics you need to run and grow your business.

- Payroll Payroll essentials you need to run your business.

- Taxes Tax basics you need to stay compliant and run your business.

- Employees Everything you need to know about managing and retaining employees.

Cash flow guide: Definition, types, how to analyze

Financial statements: What business owners should know

- Growing a Business The tools and resources you need to take your business to the next level.

- Sales & Marketing Spread the word: What you need to know about marketing your small business.

- Funding How to find funding and capital for your new or growing business.

- Midsize Businesses The tools and resources you need to manage your mid-sized business.

- Enterprise Suite Blog The tools and resources you need to grow your own business with confidence.

- E-Commerce How to start and run a successful e-commerce business.

45+ small business grants to apply for [plus tips, resources, and alternatives]

How to choose the best payment method for small businesses

- News Browse the latest news, press releases, and reports from QuickBooks.

- AI-Powered Invoice Generator Try out this free invoice generator to create an invoice online using Intuit Assist.

- Small Business Data The latest research and insights for Small Businesses from QuickBooks.

- Holiday Success Everything you need to thrive during your business's busiest seasons.

- Multimedia Hub Listen to the Mind the Business podcast by QuickBooks and iHeart. Browse videos, data, interactive resources, and free tools.

Intuit QuickBooks Small Business Index

Small Business Success Month 2024: New data reveals what success looks like for small businesses this year

- All Tools Free accounting tools and templates to speed up and simplify your workflow.

- Payment Cost Calculator Find out how much you could save by switching to QuickBooks Payments.

- Paycheck Calculator Accurately estimate pay for all your employees.

How to start a business with no money in 8 steps (+ free business plan template)

We’ve all dreamt of starting our own business at one time or another. According to a recent QuickBooks survey , over half of Americans say that digital technology has made starting a new business possible—and easier than ever to figure out how to start a business with no money.

Today, it’s faster and easier than ever to get your business up and running without the need for funding. Let’s look at starting at the eight steps it takes to start a business with no money—turning your existing skill set into a successful business on a shoestring budget:

- Find your free business idea

- Write a realistic business plan and budget

- Network and leverage free resources

- Create a website

- Make a marketing plan

- Build your brand

- Validate your business

- Get funding

1. Find your free business idea

The first step is to find a free (or low-cost) business idea. There are many different business ventures you can embark on with little to no capital needed. Here are a few easy ideas to help get your business ideas flowing:

- Creative businesses: Freelance writing, graphic design, social media management

- Online businesses: Affiliate marketing, dropshipping, e-commerce

- Service businesses: Consulting, event planning, landscaping

Instead of trying to live off your savings or a credit card, consider keeping your day job or going part-time until you get your business in a comfortable position financially.

To determine if you’re in the position to comfortably leave your day job, consider the following:

- Do you have enough savings to cover your living expenses for several months without income? The general recommendation is 3-6 months, but having more can provide peace of mind.

- How much debt do you have? Managing small business debt is important as high-interest debt can eat into your savings quickly.

- Will you have any other income besides your job? This could include freelance work, a partner's income, or investment income.

Having a steady income as you grow your business will allow you to be more flexible when it comes to your business finances.

2. Write a realistic business plan and budget

A business plan helps outline your goals and how you can reach them. It includes the key aspects of your business, such as your company description, business model, market research, products and services, and finances.

The finance and budget part of your business plan outlines how you manage startup costs and maintain cash flow.

Typical startup business expenses include:

- Office furniture and supplies

- Tools and equipment

- Raw materials

- Opening inventory

- Website design and hosting

- Advertising or promotions

- Insurance, licenses, or permit fees

Determine what expenses are the most necessary to operating your business, what you can do without, and how much money you’ll need to set aside for each expense. This can help you determine how much money you’ll need for additional funding.

You're never too small to feel more stable

With competitive APY, no monthly fees, and seamless payments—QuickBooks Money works harder for those who work for themselves.**

3. Network and leverage free resources

Starting a business with no money means networking and engaging with the small business or entrepreneur community. You can do this through online platforms, social media, or local business groups. You may also choose to find a business mentor to help guide you.

There are also plenty of free online resources that can help. For example, mentorship programs and learning materials. Some helpful websites that offer a ton of free resources include:

- Service Corps of Retired Executives (SCORE)

- Small Business Development Centers (SBDCs)

- US Chamber of Commerce

- QuickBooks tools and resources center

These free tools and resources can help you minimize spending so you can focus on building your business. However, you can also enlist the help of friends and family to support your business.

4. Create a website

When thinking about starting a business, you’ll need many things, like inventory and marketing materials. However, most modern businesses, whether it’s a landscaping company or a woodworking solopreneurship, can benefit from a website.

You can use free or low-cost website builders to create a professional website that includes information about your business, products or services, and contact details.

5. Make a marketing plan

Building a marketing budget for your low-cost startup plan is the next step. A marketing plan should support building your online presence through your website, blog posts, social media, and other areas to reach customers.

Your marketing plan should detail how you’ll promote your business to your target market, whether it’s via social media, public relations, or website optimization.

6. Build your brand

After building out a marketing plan, it’s time to start building your brand. You can analyze your competitors' websites and social media for free to see if there's a gap in the market for your brand. You can also ask friends and family to try out your product and give you feedback.

When first figuring out how to build a brand , you’ll want to outline your mission, values, and brand voice. Other brand-related things to consider include your logo and imagery. Your brand guidelines can help inform your business strategy as it grows, including your social media marketing, hiring practices, and communication style.

7. Validate your business

Before spending all of your money on inventory or building out other aspects of your business, you should validate your business idea. To do this, you can use preorders or other methods like:

- Create a landing page that explains your product or service and includes a call-to-action to allow visitors to get email updates or pre-order notifications.

- Conduct surveys or interviews with your target audience to understand their needs and pain points.

- Use pre-order marketplaces to sell your new products and connect with early adopters.

- Try pop-up events and shops at local markets, industry events, or trade shows to showcase your idea and collect pre-orders in person.

- Run crowdfund campaigns to showcase your product and collect pre-orders.

When validating your business idea, offer incentives and build hype. For example, you can use early-bird discounts, exclusive bonuses, or limited-edition items to encourage pre-orders.

8. Get funding

Once you validate your business idea, you can consider raising funding to grow your business further. For example:

- Crowdfunding is the process of raising funds from potential customers for a project or new business venture through crowdfunding platforms .

- Funding from friends and family is a common source of financing that many use to help get their business off the ground.

- Small business loans , like those from the SBA or term loans from QuickBooks .

- Grant programs from government and private sources that you don’t have to pay back.

Nearly 60% of small business owners use credit cards to temporarily fund their businesses, according to a recent QuickBooks survey . If you have a good credit rating, this can be a faster and easier way to get a loan, as you don’t need a business plan and don’t have to go through a lengthy application and underwriting process. The downside is that interest rates can be very high.

Start your business with confidence

After figuring out how to start a business with no money, you’re ready to run your business. You’ll need to register your business and get ready to collect payments. Accounting software like QuickBooks Online helps you keep your finances in order and allows you to collect payments in various ways, such as digitally or right through an invoice.

How to start a business with no money FAQ

Yes, most businesses will need a business license, whether it’s a local, state, or federal one. Common licenses for low-cost businesses include general business licenses and sales tax permits .

The cost to start a business can vary, but you can start a business with little to no money. However, some businesses may require thousands of dollars and funding from grants or loans.

Yes, you can start a business with less than $100 by utilizing the skills or resources you already have. For example, if you enjoy writing, you can use your skills to get paid as a freelance writer, using a laptop you already have and working from home.

Recommended for you

Best small business crowdfunding sites

April 22, 2021

May 1, 2024

Starting a business

How to get a small business loan: Guide & tips

June 17, 2022

Get the latest to your inbox

Relevant resources to help start, run, and grow your business.

By clicking “Submit,” you agree to permit Intuit to contact you regarding QuickBooks and have read and acknowledge our Privacy Statement .

Thanks for subscribing.

Fresh business resources are headed your way!

This content is for information purposes only and should not be considered legal, accounting, or tax advice, or a substitute for obtaining such advice specific to your business. Additional information and exceptions may apply. Applicable laws may vary by state or locality. No assurance is given that the information is comprehensive in its coverage or that it is suitable in dealing with a customer’s particular situation. Intuit Inc. does not have any responsibility for updating or revising any information presented herein. Accordingly, the information provided should not be relied upon as a substitute for independent research. Intuit Inc. does not warrant that the material contained herein will continue to be accurate nor that it is completely free of errors when published. Readers should verify statements before relying on them.

We provide third-party links as a convenience and for informational purposes only. Intuit does not endorse or approve these products and services, or the opinions of these corporations or organizations or individuals. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Looking for something else?

From big jobs to small tasks, we've got your business covered.

Firm of the Future

Topical articles and news from top pros and Intuit product experts.