Table of Contents

How to make a business plan

How to make a good business plan: step-by-step guide.

A business plan is a strategic roadmap used to navigate the challenging journey of entrepreneurship. It's the foundation upon which you build a successful business.

A well-crafted business plan can help you define your vision, clarify your goals, and identify potential problems before they arise.

But where do you start? How do you create a business plan that sets you up for success?

This article will explore the step-by-step process of creating a comprehensive business plan.

What is a business plan?

A business plan is a formal document that outlines a business's objectives, strategies, and operational procedures. It typically includes the following information about a company:

Products or services

Target market

Competitors

Marketing and sales strategies

Financial plan

Management team

A business plan serves as a roadmap for a company's success and provides a blueprint for its growth and development. It helps entrepreneurs and business owners organize their ideas, evaluate the feasibility, and identify potential challenges and opportunities.

As well as serving as a guide for business owners, a business plan can attract investors and secure funding. It demonstrates the company's understanding of the market, its ability to generate revenue and profits, and its strategy for managing risks and achieving success.

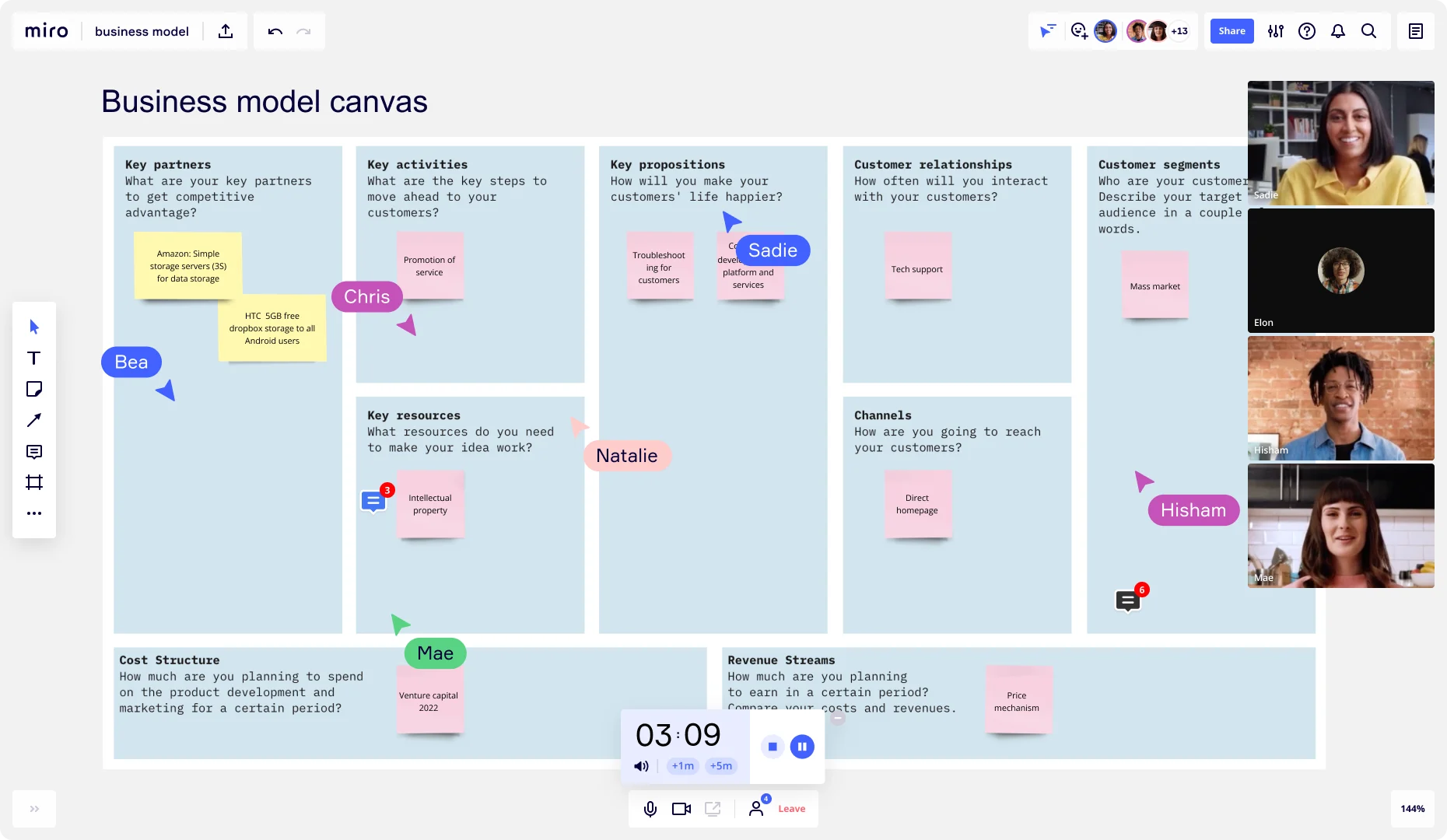

Business plan vs. business model canvas

A business plan may seem similar to a business model canvas, but each document serves a different purpose.

A business model canvas is a high-level overview that helps entrepreneurs and business owners quickly test and iterate their ideas. It is often a one-page document that briefly outlines the following:

Key partnerships

Key activities

Key propositions

Customer relationships

Customer segments

Key resources

Cost structure

Revenue streams

On the other hand, a Business Plan Template provides a more in-depth analysis of a company's strategy and operations. It is typically a lengthy document and requires significant time and effort to develop.

A business model shouldn’t replace a business plan, and vice versa. Business owners should lay the foundations and visually capture the most important information with a Business Model Canvas Template . Because this is a fast and efficient way to communicate a business idea, a business model canvas is a good starting point before developing a more comprehensive business plan.

A business plan can aim to secure funding from investors or lenders, while a business model canvas communicates a business idea to potential customers or partners.

Why is a business plan important?

A business plan is crucial for any entrepreneur or business owner wanting to increase their chances of success.

Here are some of the many benefits of having a thorough business plan.

Helps to define the business goals and objectives

A business plan encourages you to think critically about your goals and objectives. Doing so lets you clearly understand what you want to achieve and how you plan to get there.

A well-defined set of goals, objectives, and key results also provides a sense of direction and purpose, which helps keep business owners focused and motivated.

Guides decision-making

A business plan requires you to consider different scenarios and potential problems that may arise in your business. This awareness allows you to devise strategies to deal with these issues and avoid pitfalls.

With a clear plan, entrepreneurs can make informed decisions aligning with their overall business goals and objectives. This helps reduce the risk of making costly mistakes and ensures they make decisions with long-term success in mind.

Attracts investors and secures funding

Investors and lenders often require a business plan before considering investing in your business. A document that outlines the company's goals, objectives, and financial forecasts can help instill confidence in potential investors and lenders.

A well-written business plan demonstrates that you have thoroughly thought through your business idea and have a solid plan for success.

Identifies potential challenges and risks

A business plan requires entrepreneurs to consider potential challenges and risks that could impact their business. For example:

Is there enough demand for my product or service?

Will I have enough capital to start my business?

Is the market oversaturated with too many competitors?

What will happen if my marketing strategy is ineffective?

By identifying these potential challenges, entrepreneurs can develop strategies to mitigate risks and overcome challenges. This can reduce the likelihood of costly mistakes and ensure the business is well-positioned to take on any challenges.

Provides a basis for measuring success

A business plan serves as a framework for measuring success by providing clear goals and financial projections . Entrepreneurs can regularly refer to the original business plan as a benchmark to measure progress. By comparing the current business position to initial forecasts, business owners can answer questions such as:

Are we where we want to be at this point?

Did we achieve our goals?

If not, why not, and what do we need to do?

After assessing whether the business is meeting its objectives or falling short, business owners can adjust their strategies as needed.

How to make a business plan step by step

The steps below will guide you through the process of creating a business plan and what key components you need to include.

1. Create an executive summary

Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Keep your executive summary concise and clear with the Executive Summary Template . The simple design helps readers understand the crux of your business plan without reading the entire document.

2. Write your company description

Provide a detailed explanation of your company. Include information on what your company does, the mission statement, and your vision for the future.

Provide additional background information on the history of your company, the founders, and any notable achievements or milestones.

3. Conduct a market analysis

Conduct an in-depth analysis of your industry, competitors, and target market. This is best done with a SWOT analysis to identify your strengths, weaknesses, opportunities, and threats. Next, identify your target market's needs, demographics, and behaviors.

Use the Competitive Analysis Template to brainstorm answers to simple questions like:

What does the current market look like?

Who are your competitors?

What are they offering?

What will give you a competitive advantage?

Who is your target market?

What are they looking for and why?

How will your product or service satisfy a need?

These questions should give you valuable insights into the current market and where your business stands.

4. Describe your products and services

Provide detailed information about your products and services. This includes pricing information, product features, and any unique selling points.

Use the Product/Market Fit Template to explain how your products meet the needs of your target market. Describe what sets them apart from the competition.

5. Design a marketing and sales strategy

Outline how you plan to promote and sell your products. Your marketing strategy and sales strategy should include information about your:

Pricing strategy

Advertising and promotional tactics

Sales channels

The Go to Market Strategy Template is a great way to visually map how you plan to launch your product or service in a new or existing market.

6. Determine budget and financial projections

Document detailed information on your business’ finances. Describe the current financial position of the company and how you expect the finances to play out.

Some details to include in this section are:

Startup costs

Revenue projections

Profit and loss statement

Funding you have received or plan to receive

Strategy for raising funds

7. Set the organization and management structure

Define how your company is structured and who will be responsible for each aspect of the business. Use the Business Organizational Chart Template to visually map the company’s teams, roles, and hierarchy.

As well as the organization and management structure, discuss the legal structure of your business. Clarify whether your business is a corporation, partnership, sole proprietorship, or LLC.

8. Make an action plan

At this point in your business plan, you’ve described what you’re aiming for. But how are you going to get there? The Action Plan Template describes the following steps to move your business plan forward. Outline the next steps you plan to take to bring your business plan to fruition.

Types of business plans

Several types of business plans cater to different purposes and stages of a company's lifecycle. Here are some of the most common types of business plans.

Startup business plan

A startup business plan is typically an entrepreneur's first business plan. This document helps entrepreneurs articulate their business idea when starting a new business.

Not sure how to make a business plan for a startup? It’s pretty similar to a regular business plan, except the primary purpose of a startup business plan is to convince investors to provide funding for the business. A startup business plan also outlines the potential target market, product/service offering, marketing plan, and financial projections.

Strategic business plan

A strategic business plan is a long-term plan that outlines a company's overall strategy, objectives, and tactics. This type of strategic plan focuses on the big picture and helps business owners set goals and priorities and measure progress.

The primary purpose of a strategic business plan is to provide direction and guidance to the company's management team and stakeholders. The plan typically covers a period of three to five years.

Operational business plan

An operational business plan is a detailed document that outlines the day-to-day operations of a business. It focuses on the specific activities and processes required to run the business, such as:

Organizational structure

Staffing plan

Production plan

Quality control

Inventory management

Supply chain

The primary purpose of an operational business plan is to ensure that the business runs efficiently and effectively. It helps business owners manage their resources, track their performance, and identify areas for improvement.

Growth-business plan

A growth-business plan is a strategic plan that outlines how a company plans to expand its business. It helps business owners identify new market opportunities and increase revenue and profitability. The primary purpose of a growth-business plan is to provide a roadmap for the company's expansion and growth.

The 3 Horizons of Growth Template is a great tool to identify new areas of growth. This framework categorizes growth opportunities into three categories: Horizon 1 (core business), Horizon 2 (emerging business), and Horizon 3 (potential business).

One-page business plan

A one-page business plan is a condensed version of a full business plan that focuses on the most critical aspects of a business. It’s a great tool for entrepreneurs who want to quickly communicate their business idea to potential investors, partners, or employees.

A one-page business plan typically includes sections such as business concept, value proposition, revenue streams, and cost structure.

Best practices for how to make a good business plan

Here are some additional tips for creating a business plan:

Use a template

A template can help you organize your thoughts and effectively communicate your business ideas and strategies. Starting with a template can also save you time and effort when formatting your plan.

Miro’s extensive library of customizable templates includes all the necessary sections for a comprehensive business plan. With our templates, you can confidently present your business plans to stakeholders and investors.

Be practical

Avoid overestimating revenue projections or underestimating expenses. Your business plan should be grounded in practical realities like your budget, resources, and capabilities.

Be specific

Provide as much detail as possible in your business plan. A specific plan is easier to execute because it provides clear guidance on what needs to be done and how. Without specific details, your plan may be too broad or vague, making it difficult to know where to start or how to measure success.

Be thorough with your research

Conduct thorough research to fully understand the market, your competitors, and your target audience . By conducting thorough research, you can identify potential risks and challenges your business may face and develop strategies to mitigate them.

Get input from others

It can be easy to become overly focused on your vision and ideas, leading to tunnel vision and a lack of objectivity. By seeking input from others, you can identify potential opportunities you may have overlooked.

Review and revise regularly

A business plan is a living document. You should update it regularly to reflect market, industry, and business changes. Set aside time for regular reviews and revisions to ensure your plan remains relevant and effective.

Create a winning business plan to chart your path to success

Starting or growing a business can be challenging, but it doesn't have to be. Whether you're a seasoned entrepreneur or just starting, a well-written business plan can make or break your business’ success.

The purpose of a business plan is more than just to secure funding and attract investors. It also serves as a roadmap for achieving your business goals and realizing your vision. With the right mindset, tools, and strategies, you can develop a visually appealing, persuasive business plan.

Ready to make an effective business plan that works for you? Check out our library of ready-made strategy and planning templates and chart your path to success.

Get on board in seconds

Plans and pricing.

This website uses cookies to enhance the user experience.

What stage is your business at?

Tell us and we'll match you with a special liveplan discount:, new business discount, great, we have special savings for organizing your business ideas., get full access to liveplan for 50% off, save big with any monthly package, startup discount, great, we have special savings for businesses just starting up., save big on liveplan premium, save big with any liveplan premium package, established business discount, great, we have special savings for businesses that are up and running., get annual access to liveplan for 40% off, save big with any annual package.

Enter your email address to unlock it.

We care about your privacy. See our Privacy Policy .

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast

You can do this! Tour LivePlan to see how simple business planning can be.

Have an expert write your plan, build your forecast, and so much more.

Integrations

For Small Businesses

For Advisors & Mentors

Planning a Business

How to Write a Detailed Business Plan Step-by-Step [Free Template]

12 min. read

Updated September 23, 2024

Writing a business plan is one of the most valuable things you can do for your business.

Study after study proves that business planning significantly improves your chances of success by up to 30 percent 1 . That’s because the planning process helps you think about all aspects of your business and how it will operate and grow.

Ready to write your own detailed business plan? Here’s everything you need (along with a free business plan template ) to create your plan.

Before you write a detailed business plan, start with a one-page business plan

Despite the benefits of business planning , it’s easy to procrastinate writing a business plan.

Most people would prefer to work hands-on in their business rather than think about business strategy . That’s why, if you’re writing a business plan for the first time, we recommend you start with a simpler and shorter one-page business plan.

With a one-page plan, there’s no need to go into a lot of details or dive deep into financial projections—you just write down the fundamentals of your business and how it works.

A one-page plan should cover:

- • Value proposition

- • Market need

- • Your solution

- • Competition

- • Target market

- • Sales and marketing

- • Budget and sales goals

- • Milestones

- • Team summary

- • Key partners

- • Funding needs

A one-page business plan is a great jumping-off point in the planning process. It’ll give you an overview of your business and help you quickly refine your ideas.

Check out our guide to writing a simple one-page business plan for detailed instructions, examples, and a free downloadable one-page plan template .

When do you need a more detailed business plan?

While I will always recommend starting with the one-page plan format, there are times when a more detailed plan is necessary:

- • Flesh out sections of your plan: You need to better understand how your marketing, operations, or other business functions will operate.

- • Build a more detailed financial forecast: A one-page plan only includes a summary of your financial projections. A detailed plan includes a full financial forecast, including a profit and loss statement, balance sheet, and cash flow forecast to better measure performance.

- • Prepare for lenders and investors: While they may not read the full plan, any investor will ask in-depth questions that you can only answer by spending time writing a detailed business plan.

- • Sell your business: Use your business plan as part of your sales pitch, and show potential buyers all the details of how your business works.

How to write a detailed business plan

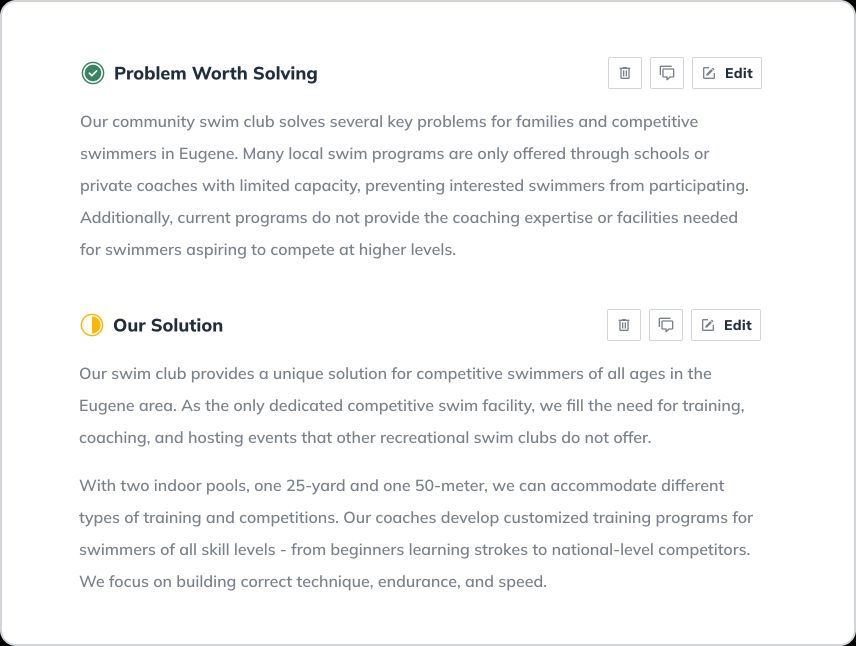

Let’s walk through writing a detailed business plan step-by-step and explore an example of what a finished business plan (for a local swim club Pools & Laps) built with LivePlan’s business plan builder looks like.

1. Executive summary

Yes, the executive summary comes first in your plan, but you should write it last—once you know all the details of your business plan.

It is just a summary of your full plan, so be careful not to be too repetitive—keep it between one or two pages and highlight:

- • Your opportunity: This summarizes what your business does, what problem it solves, and who your customers are. This is where you want readers to get excited about your business

- • Your team: For investors, your business’s team is often even more important than what the business is. Briefly highlight why your team is uniquely qualified to build the business and make it successful.

- • Financials: What are the highlights of your financial forecast ? Summarize your sales goals, when you plan to be profitable, and how much money you need to get your business off the ground.

For existing businesses, write the executive summary for your audience—whether it’s investors, business partners, or employees. Think about what your audience will want to know, and just hit the highlights.

2. Opportunity

The “opportunity” section of your business plan is all about the products and services that you are creating. The goal is to explain why your business is exciting and the problems that it solves for people. You’ll want to cover:

Problem & solution

Every successful business solves a problem for its customers. Their products and services make people’s lives easier or fill an unmet need in the marketplace.

In this section, you’ll want to explain the problem that you solve, whom you solve it for, and what your solution is. This is where you go in-depth to describe what you do and how you improve the lives of your customers.

Target market

In the previous section, you summarized your target customer. Now you’ll want to describe them in much greater detail. You’ll want to cover things like your target market’s demographics (age, gender, location, etc.) and psychographics (hobbies and other behaviors).

Ideally, you can also estimate the size of your target market so you know how many potential customers you might have.

Competition

Every business has competition , so don’t leave this section out. You’ll need to explain what other companies are doing to serve your customers or if your customers have other options for solving the problem you are solving.

Explain how your approach is different and better than your competitors, whether it’s better features, pricing, or location. Explain why a customer would come to you instead of going to another company.

3. Execution

This section of your business plan dives into how you will accomplish your goals. While the Opportunity section discussed what you’re doing, you now need to explain the specifics of how you will do it.

Marketing & sales

What marketing tactics will you use to get the word out about your business? You’ll want to explain how you get customers to your door and what the sales process looks like. For businesses with a sales force, explain how the sales team gets leads and what the process is like for closing a sale.

Depending on the type of business that you are starting, the operations section needs to be customized to meet your needs. If you are building a mail-order business, you’ll want to cover how you source your products and how fulfillment will work.

If you’re building a manufacturing business, explain the manufacturing process and the necessary facilities. This is where you’ll talk about how your business “works,” meaning you should explain what day-to-day functions and processes are needed to make your business successful.

Milestones & metrics

So far, your business plan has mostly discussed what you’re doing and how you will do it.

The milestones and metrics section is all about timing. Your plan should highlight key dates and goals that you intend to hit. You don’t need extensive project planning in this section, just key milestones that you want to hit and when you plan to hit them.

You should also discuss key metrics : the numbers you will track to determine your success.

The Company section of your business plan should explain your business’s overall structure and the team behind it.

Organizational structure

Describe your location, facilities, and anything else about your physical location relevant to your business. You’ll also want to explain the legal structure of your business—are you an S-corp, C-corp, or an LLC? What does company ownership look like?

Arguably one of the most important parts of your plan when seeking investment is the “Team” section. This should explain who you are and who else is helping you run the business. Focus on experience and qualifications for building the type of business that you want to build.

It’s OK if you don’t have a complete team yet. Just highlight the key roles that you need to fill and the type of person you hope to hire for each role.

5. Financial plan and forecasts

Your business plan now covers the “what,” the “how,” and the “when” for your business. Now it’s time to talk about money.

Financial forecasts

What revenue do you plan on bringing in, and when? What kind of expenses will you have? How much cash will you need?

These are the types of questions you’ll answer by creating detailed forecasts. Don’t worry about getting it perfect, these are just educated guesses. Your goal is to get numbers down that seem reasonable so you can review and revise financial expectations as you run your business.

You’ll want to cover sales , expenses , personnel costs , asset purchases, cash , etc, for at least the first 12 months of your business. If you can, also create educated guesses for the following two years in annual totals.

If you intend to pursue funding, it’s worth noting that some investors and lenders might want to see a five-year forecast. For most other cases, three years is usually enough.

If you’re raising money for your business, the Financing section is where you describe how much you need. Whether you’re getting loans or investments, you should highlight what and when you need it.

Ideally, you’ll also want to summarize the specific ways you’ll use the funding once you have it.

For more specifics, check out our write-up explaining what to include in your business plan for a bank loan .

Historical Financial statements

If your business is up and running, you should also include your profit and loss statement , balance sheet , and cash flow statement . These are the historical record of your business performance and will be required by lenders, investors, and anyone considering buying your business.

If you don’t want lengthy financial statements overwhelming this section of your business plan, you can just include the most recent statements and include the rest within your appendix.

6. Appendix

The final section of your business plan is the appendix . Include detailed financial forecasts here and any other key documentation for your business.

If you have product schematics, patent information, or any other details that aren’t appropriate for the main body of the plan but need to be included for reference.

Tips to write a detailed business plan

Keep it brief.

You may not be limited to one page, but that doesn’t mean you need to write a novel. Keep your business plan focused using clear, plain language and avoiding jargon. Make your plan easier to skim by using short sentences, bulleted lists, and visuals. Remember, you can always come back and add more details.

Related Reading: 7 tips to make a high-quality business plan

Start with what you know

Don’t worry about following a strict top-to-bottom approach. Instead, build momentum by starting with sections you know well. This will help you get information down and ultimately make you more likely to complete your business plan.

Set time limits

You don’t have to write your business plan in one sitting. It may be more valuable to set a time limit, see how much you get done, and return to it again in another session. This will keep you focused and productive and help you fit plan writing into your other responsibilities.

Reference business plan examples

Real-world business plan examples from your industry can provide valuable insights into how others have successfully presented their ideas, strategies, and financials. Exploring these examples can inspire your own approach and offer practical guidance on what to include and how to tailor it to your specific needs.

Just be sure not to copy and paste anything.

Prioritize sections that really matter

When writing a detailed business plan, focus on the parts most important to you and your business.

If you plan on distributing your plan to outsiders, you should complete every section. But, if your plan is just for internal use, focus on the areas that will help you right now.

Download a free business plan template

Are you ready to write your detailed business plan? Get started by downloading our free business plan template . With that, you will be well on your way to a better business strategy, with all of the necessary information expected in a more detailed plan.

If you want to improve your ability to build a healthy, growing business, consider LivePlan.

It’s a product that makes planning easy and features a guided business plan creator , drag-and-drop financial forecasting tools , and an AI-powered LivePlan Assistant to help you write, generate ideas, and analyze your business performance.

Use your detailed business plan to grow your business

Your business plan isn’t just a document to attract investors or close a bank loan. It’s a tool that helps you better manage and grow your business. And you’ll get the most value from your business plan if you use it as part of a growth planning process .

With growth planning, you’ll easily create and execute your plan, track performance, identify opportunities and issues, and consistently revise your strategy. It’s a flexible process that encourages you to build a plan that fits your needs.

So, whether you stick with a one-page plan or expand into a more detailed business plan—you’ll be ready to start growth planning.

Sources in this article

- 1. Parsons, Noah. “Do You Need a Business Plan? This Study Says Yes” Bplans: Free Business Planning Resources and Templates , 10 May 2024, www.bplans.com/business-planning/basics/research .

Like this post? Share with a friend!

Noah Parsons

Before joining Palo Alto Software , Noah Parsons was an early Internet marketing and product expert in the Silicon Valley. He joined Yahoo! in 1996 as one of its first 101 employees and become Producer of the Yahoo! Employment property as part of the Yahoo! Classifieds team before leaving to serve as Director of Production at Epinions.com. He is a graduate of Princeton University. Noah devotes most of his free time to his three young sons. In the winter you'll find him giving them lessons on the ski slopes, and in summer they're usually involved in a variety of outdoor pursuits. Noah is currently the COO at Palo Alto Software, makers of the online business plan app LivePlan.

Table of Contents

Related articles.

Peter Thorsson

August 26, 2024

How to Create Your First Financial Forecast With No Historical Data

October 17, 2024

What Is Accounts Receivable (AR)? [Definition + 6 Ways to Improve]

September 23, 2024

15 Reasons Why You Need a Business Plan in 2024

October 1, 2024

Cash Flow Statement: Definition + How to Create and Read it

- Credit cards

- View all credit cards

- Banking guide

- Loans guide

- Insurance guide

- Personal finance

- View all personal finance

- Small business

- Small business guide

- View all taxes

You’re our first priority. Every time.

We believe everyone should be able to make financial decisions with confidence. And while our site doesn’t feature every company or financial product available on the market, we’re proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward — and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about (and where those products appear on the site), but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services. Here is a list of our partners .

How to Write a Business Plan, Step by Step

Many, or all, of the products featured on this page are from our advertising partners who compensate us when you take certain actions on our website or click to take an action on their website. However, this does not influence our evaluations. Our opinions are our own. Here is a list of our partners and here's how we make money .

What is a business plan?

1. write an executive summary, 2. describe your company, 3. state your business goals, 4. describe your products and services, 5. do your market research, 6. outline your marketing and sales plan, 7. perform a business financial analysis, 8. make financial projections, 9. summarize how your company operates, 10. add any additional information to an appendix, business plan tips and resources.

A business plan outlines your business’s financial goals and explains how you’ll achieve them over the next three to five years. Here’s a step-by-step guide to writing a business plan that will offer a strong, detailed road map for your business.

LLC Formation

on ZenBusiness' website

A business plan is a document that explains what your business does, how it makes money and who its customers are. Internally, writing a business plan should help you clarify your vision and organize your operations. Externally, you can share it with potential lenders and investors to show them you’re on the right track.

Business plans are living documents; it’s OK for them to change over time. Startups may update their business plans often as they figure out who their customers are and what products and services fit them best. Mature companies might only revisit their business plan every few years. Regardless of your business’s age, brush up this document before you apply for a business loan .

» Need help writing? Learn about the best business plan software .

This is your elevator pitch. It should include a mission statement, a brief description of the products or services your business offers and a broad summary of your financial growth plans.

Though the executive summary is the first thing your investors will read, it can be easier to write it last. That way, you can highlight information you’ve identified while writing other sections that go into more detail.

» MORE: How to write an executive summary in 6 steps

Next up is your company description. This should contain basic information like:

Your business’s registered name.

Address of your business location .

Names of key people in the business. Make sure to highlight unique skills or technical expertise among members of your team.

Your company description should also define your business structure — such as a sole proprietorship, partnership or corporation — and include the percent ownership that each owner has and the extent of each owner’s involvement in the company.

Lastly, write a little about the history of your company and the nature of your business now. This prepares the reader to learn about your goals in the next section.

» MORE: How to write a company overview for a business plan

The third part of a business plan is an objective statement. This section spells out what you’d like to accomplish, both in the near term and over the coming years.

If you’re looking for a business loan or outside investment, you can use this section to explain how the financing will help your business grow and how you plan to achieve those growth targets. The key is to provide a clear explanation of the opportunity your business presents to the lender.

For example, if your business is launching a second product line, you might explain how the loan will help your company launch that new product and how much you think sales will increase over the next three years as a result.

» MORE: How to write a successful business plan for a loan

In this section, go into detail about the products or services you offer or plan to offer.

You should include the following:

An explanation of how your product or service works.

The pricing model for your product or service.

The typical customers you serve.

Your supply chain and order fulfillment strategy.

You can also discuss current or pending trademarks and patents associated with your product or service.

Lenders and investors will want to know what sets your product apart from your competition. In your market analysis section , explain who your competitors are. Discuss what they do well, and point out what you can do better. If you’re serving a different or underserved market, explain that.

Here, you can address how you plan to persuade customers to buy your products or services, or how you will develop customer loyalty that will lead to repeat business.

Include details about your sales and distribution strategies, including the costs involved in selling each product .

» MORE: R e a d our complete guide to small business marketing

If you’re a startup, you may not have much information on your business financials yet. However, if you’re an existing business, you’ll want to include income or profit-and-loss statements, a balance sheet that lists your assets and debts, and a cash flow statement that shows how cash comes into and goes out of the company.

Accounting software may be able to generate these reports for you. It may also help you calculate metrics such as:

Net profit margin: the percentage of revenue you keep as net income.

Current ratio: the measurement of your liquidity and ability to repay debts.

Accounts receivable turnover ratio: a measurement of how frequently you collect on receivables per year.

This is a great place to include charts and graphs that make it easy for those reading your plan to understand the financial health of your business.

This is a critical part of your business plan if you’re seeking financing or investors. It outlines how your business will generate enough profit to repay the loan or how you will earn a decent return for investors.

Here, you’ll provide your business’s monthly or quarterly sales, expenses and profit estimates over at least a three-year period — with the future numbers assuming you’ve obtained a new loan.

Accuracy is key, so carefully analyze your past financial statements before giving projections. Your goals may be aggressive, but they should also be realistic.

NerdWallet’s picks for setting up your business finances:

The best business checking accounts .

The best business credit cards .

The best accounting software .

Before the end of your business plan, summarize how your business is structured and outline each team’s responsibilities. This will help your readers understand who performs each of the functions you’ve described above — making and selling your products or services — and how much each of those functions cost.

If any of your employees have exceptional skills, you may want to include their resumes to help explain the competitive advantage they give you.

Finally, attach any supporting information or additional materials that you couldn’t fit in elsewhere. That might include:

Licenses and permits.

Equipment leases.

Bank statements.

Details of your personal and business credit history, if you’re seeking financing.

If the appendix is long, you may want to consider adding a table of contents at the beginning of this section.

How much do you need?

with Fundera by NerdWallet

We’ll start with a brief questionnaire to better understand the unique needs of your business.

Once we uncover your personalized matches, our team will consult you on the process moving forward.

Here are some tips to write a detailed, convincing business plan:

Avoid over-optimism: If you’re applying for a business bank loan or professional investment, someone will be reading your business plan closely. Providing unreasonable sales estimates can hurt your chances of approval.

Proofread: Spelling, punctuation and grammatical errors can jump off the page and turn off lenders and prospective investors. If writing and editing aren't your strong suit, you may want to hire a professional business plan writer, copy editor or proofreader.

Use free resources: SCORE is a nonprofit association that offers a large network of volunteer business mentors and experts who can help you write or edit your business plan. The U.S. Small Business Administration’s Small Business Development Centers , which provide free business consulting and help with business plan development, can also be a resource.

On a similar note...

🎧 Real entrepreneurs. Real stories.

Subscribe to The Hurdle podcast today!

How to Write a Five-Year Business Plan

Noah Parsons

15 min. read

Updated October 27, 2023

Learn why the traditional way of writing a five-year business plan is often a waste of time and how to use a one-page plan instead for smarter, easier strategic planning to establish your long-term vision.

In business, it can sometimes seem hard enough to predict what’s going to happen next month, let alone three or even five years from now. But, that doesn’t mean that you shouldn’t plan for the long term. After all, your vision for the future is what gets you out of bed in the morning and motivates your team. It’s those aspirations that drive you to keep innovating and figuring out how to grow.

- What is a long-term plan?

A long-term or long-range business plan looks beyond the traditional 3-year planning window, focusing on what a business might look like 5 or even 10 years from now. A traditional 5-year business plan includes financial projections, business strategy, and roadmaps that stretch far into the future.

I’ll be honest with you, though—for most businesses, long-range business plans that stretch 5 and 10 years into the future are a waste of time. Anyone who’s seriously asking you for one doesn’t know what they’re doing and is wasting your time. Sorry if that offends some people, but it’s true.

However, there is still real value in looking at the long term. Just don’t invest the time in creating a lengthy version of your business plan with overly detailed metrics and milestones for the next five-plus years. No one knows the future and, more than likely, anything you write down now could be obsolete in the next year, next month, or even next week.

That’s where long-term strategic planning comes in. A long-term business plan like this is different from a traditional business plan in that it’s lighter on the details and more focused on your strategic direction. It has less focus on financial forecasting and a greater focus on the big picture.

Think of your long-term strategic plan as your aspirational vision for your business. It defines the ideal direction you’re aiming for but it’s not influencing your day-to-day or, potentially, even your monthly decision making.

- Are long-term business plans a waste of time?

No one knows the future. We’re all just taking the information that we have available today and making our best guesses about the future. Sometimes trends in a market are pretty clear and your guesses will be well-founded. Other times, you’re trying to look around a corner and hoping that your intuition about what comes next is correct.

Now, I’m not saying that thinking about the future is a waste of time. Entrepreneurs are always thinking about the future. They have to have some degree of faith and certainty about what customers are going to want in the future. Successful entrepreneurs do actually predict the future — they know what customers are going to want and when they’re going to want it.

Entrepreneurship is unpredictable

Successful entrepreneurs are also often wrong. They make mistakes just like the rest of us. The difference between successful entrepreneurs and everyone else is that they don’t let mistakes slow them down. They learn from mistakes, adjust and try again. And again. And again. It’s not about being right all the time; it’s about having the perseverance to keep trying until you get it right. For example, James Dyson, inventor of the iconic vacuum cleaner, tried out 5,126 prototypes of his invention before he found a design that worked.

So, if thinking about the future isn’t a waste of time, why are 5-year business plans a waste of time? They’re a waste of time because they typically follow the same format as a traditional business plan, where you are asked to project sales, expenses, and cash flow 5 and 10 years into the future.

Let’s be real. Sales and expense projections that far into the future are just wild guesses, especially for startups and new businesses. They’re guaranteed to be wrong and can’t be used for anything. You can’t (and shouldn’t) make decisions based on these guesses. They’re just fantasy. You hope you achieve massive year-over-year growth in sales, but there’s no guarantee that’s going to happen. And, you shouldn’t make significant spending decisions today based on the hope of massive sales 10 years from now.

Brought to you by

Create a professional business plan

Using ai and step-by-step instructions.

Secure funding

Validate ideas

Build a strategy

- Why write a long-term business plan?

So, what is the purpose of outlining a long-term plan? Here are a few key reasons why it’s still valuable to consider the future of your business without getting bogged down by the details.

Showcase your vision for investors

First, and especially important if you are raising money from investors, is your vision. Investors will want to know not only where you plan on being in a year, but where the business will be in five years. Do you anticipate launching new products or services? Will you expand internationally? Or will you find new markets to grow into?

Set long-term goals for your business

Second, you’ll want to establish goals for yourself and your team. What kinds of high-level sales targets do you hope to achieve? How big is your company going to get overtime? These goals can be used to motivate your team and even help in the hiring process as you get up and running.

That said, you don’t want to overinvest in fleshing out all the details of a long-range plan. You don’t need to figure out exactly how your expansion will work years from now or exactly how much you’ll spend on office supplies five years from now. That’s really just a waste of time.

Instead, for long-range planning, think in broad terms. A good planning process means that you’re constantly revising and refining your business plan. You’ll add more specifics as you go, creating a detailed plan for the next 6-12 months and a broader, vague plan for the long term.

You have a long development time

Businesses with extremely long research and development timelines do make spending decisions now based on the hope of results years from now. For example, the pharmaceutical industry and medical device industry have to make these bets all the time. The R&D required to take a concept from idea to proven product with regulatory approval can take years for these industries, so long-range planning in these cases is a must. A handful of other industries also have similar development timelines, but these are the exceptions, not the rule.

Your business is well-established and predictable

Long-term, detailed planning can make more sense for businesses that are extremely well established and have long histories of consistent sales and expenses with predictable growth. But, even for those businesses, predictability means quite the opposite of stability. The chances that you’ll be disrupted in the marketplace by a new company, or the changing needs and desires of your customers, is extremely high. So, most likely, those long-range predictions of sales and profits are pretty useless.

- What a 5-year plan should look like

With the exception of R&D-heavy businesses, most 5-year business plans should be more like vision statements than traditional business plans. They should explain your vision for the future, but skip the details of detailed sales projections and expense budgets.

Your vision for your business should explain the types of products and services that you hope to offer in the future and the types of customers that you hope to serve. Your plan should outline who you plan to serve now and how you plan to expand if you are successful.

This kind of future vision creates a strategic roadmap. It’s not a fully detailed plan with sales forecasts and expense budgets, but a plan for getting started and then growing over time to reach your final destination.

For example, here’s a short-form version of what a long-term plan for Nike might have looked like if one had been written in the 1960s:

Nike will start by developing high-end track shoes for elite athletes. We’ll start with a focus on the North West of the US, but expand nationally as we develop brand recognition among track and field athletes. We will use sponsored athletes to spread the word about the quality and performance of our shoes. Once we have success in the track & field market segment, we believe that we will be able to successfully expand both beyond the US market and also branch out into other sports, with an initial focus on basketball.

Leadership and brand awareness in a sport such as basketball will enable us to cross over from the athlete market into the consumer market. This will lead to significant business growth in the consumer segment and allow for expansion into additional sports, fashion, and casual markets in addition to building a strong apparel brand.

Interestingly enough, Nike (to my knowledge) never wrote out a long-range business plan. They developed their plans as they grew, building the proverbial airplane as it took off.

But, if you have this kind of vision for your business, it’s useful to articulate it. Your employees will want to know what your vision is and your investors will want to know as well. They want to know that you, as an entrepreneur, are looking beyond tomorrow and into the future months and years ahead.

- How to write a five-year business plan

Writing out your long-term vision for your business is a useful exercise. It can bring a sense of stability and solidify key performance indicators and broad milestones that drive your business.

Developing a long-range business plan is really just an extension of your regular business planning process. A typical business plan covers the next one to three years, documenting your target market, marketing strategy, and product or service offerings for that time period.

A five-year plan expands off of that initial strategy and discusses what your business might do in the years to come. However, as I’ve mentioned before, creating a fully detailed five-year business plan will be a waste of time.

Here’s a quick guide to writing a business plan that looks further into the future without wasting your time:

1. Develop your one-page plan

As with all business planning, we recommend that you start with a one-page business plan. It provides a snapshot of what you’re hoping to achieve in the immediate term by outlining your core business strategy, target market, and business model.

A one-page plan is the foundation of all other planning because it’s the document that you’ll keep the most current. It’s also the easiest to update and share with business partners. You will typically highlight up to three years of revenue and profit goals as well as milestones that you hope to achieve in the near term.

Check out our guide to building your one-page plan and download a free template to get started.

2. Determine if you need a traditional business plan

Unlike a one-page business plan, a traditional business plan is more detailed and is typically written in long-form prose. A traditional business plan is usually 10-20 pages long and contains details about your product or service, summaries of the market research that you’ve conducted, and details about your competition. Read our complete guide to writing a business plan .

Companies that write traditional business plans typically have a “business plan event” where a complete business plan is required. Business plan events are usually part of the fundraising process. During fundraising, lenders and investors may ask to see a detailed plan and it’s important to be ready if that request comes up.

But there are other good reasons to write a detailed business plan. A detailed plan forces you to think through the details of your business and how, exactly, you’re going to build your business. Detailed plans encourage you to think through your business strategy, your target market, and your competition carefully. A good business plan ensures that your strategy is complete and fleshed out, not just a collection of vague ideas.

A traditional business plan is also a good foundation for a long-term business plan and I recommend that you expand your lean business plan into a complete business plan if you intend to create plans for more than three years into the future.

3. Develop long-term goals and growth targets

As you work on your business plan, you’ll need to think about where you want to be in 5+ years. A good exercise is to envision what your business will look like. How many employees will you have? How many locations will you serve? Will you introduce new products and services?

When you’ve envisioned where you want your business to be, it’s time to turn that vision into a set of goals that you’ll document in your business plan. Each section of your business plan will be expanded to highlight where you want to be in the future. For example, in your target market section, you will start by describing your initial target market. Then you’ll proceed to describe the markets that you hope to reach in 3-5 years.

To accompany your long-term goals, you’ll also need to establish revenue targets that you think you’ll need to meet to achieve your goals. It’s important to also think about the expenses you’re going to incur in order to grow your business.

For long-range planning, I recommend thinking about your expenses in broad buckets such as “marketing” and “product development” without getting bogged down in too much detail. Think about what percentage of your sales you’ll spend on each of these broad buckets. For example, marketing spending might be 20% of sales.

4. Develop a 3-5 year strategic plan

Your goals and growth targets are “what” you want to achieve. Your strategy is “how” you’re going to achieve it.

Use your business plan to document your strategy for growth. You might be expanding your product offering, expanding your market, or some combination of the two. You’ll need to think about exactly how this process will happen over the next 3-5 years.

A good way to document your strategy is to use milestones. These are interim goals that you’ll set to mark your progress along the way to your larger goal. For example, you may have a goal to expand your business nationally from your initial regional presence. You probably won’t expand across the country all at once, though. Most likely, you’ll expand into certain regions one at a time and grow to have a national presence over time. Your strategy will be the order of the regions that you plan on expanding into and why you pick certain regions over others.

Your 3-5 year strategy may also include what’s called an “exit strategy”. This part of a business plan is often required if you’re raising money from investors. They’ll want to know how they’ll eventually get their money back. An “exit” can be the sale of your business or potentially going public. A typical exit strategy will identify potential acquirers for your business and will show that you’ve thought about how your business might be an attractive purchase.

5. Tie your long-term plan to your one-page plan

As your business grows, you can use your long-term business plan as your north star. Your guide for where you want to end up. Use those goals to steer your business in the right direction, making small course corrections as you need to.

You’ll reflect those smaller course corrections in your one-page plan. Because it is a simple document and looks at the shorter term, it’s easier to update. The best way to do this is to set aside a small amount of time to review your plan once a month. You’ll review your financial forecast, your milestones, and your overall strategy. If things need to change, you can make those adjustments. Nothing ever goes exactly to plan, so it’s OK to make corrections as you go.

You may find that your long-term plan may also need corrections as you grow your business. You may learn things about your market that change your initial assumptions and impacts your long-range plan. This is perfectly normal. Once a quarter or so, zoom out and review your long-range plan. If you need to make corrections to your strategy and goals, that’s fine. Just keep your plan alive so that it gives you the guidance that you need over time.

- Vision setting is the purpose of long-term planning

Part of what makes entrepreneurs special is that they have a vision. They have dreams for where they want their business to go. A 5-year business plan should be about documenting that vision for the future and how your business will capitalize on that vision.

So, if someone asks you for your 5-year business plan. Don’t scramble to put together a sales forecast and budget for 5 years from now. Your best guess today will be obsolete tomorrow. Instead, focus on your vision and communicate that.

Explain where you think your business is going and what you think the market is going to be like 5 years from now. Explain what you think customers are going to want and where trends are headed and how you’re going to be there to sell the solution to the problems that exist in 5 and 10 years. Just skip the invented forecasts and fantasy budgets.

Noah is the COO at Palo Alto Software, makers of the online business plan app LivePlan. He started his career at Yahoo! and then helped start the user review site Epinions.com. From there he started a software distribution business in the UK before coming to Palo Alto Software to run the marketing and product teams.

Table of Contents

Related Articles

5 Min. Read

How to Write a Growth-Oriented Business Plan

6 Min. Read

Differences Between Single-Use and Standing Plans Explained

8 Min. Read

What Type of Business Plan Do You Need?

11 Min. Read

Fundamentals of Lean Planning Explained

The LivePlan Newsletter

Become a smarter, more strategic entrepreneur.

Your first monthly newsetter will be delivered soon..

Unsubscribe anytime. Privacy policy .

The quickest way to turn a business idea into a business plan

Fill-in-the-blanks and automatic financials make it easy.

No thanks, I prefer writing 40-page documents.

Discover the world’s #1 plan building software

COMMENTS

A good business plan guides you through each stage of starting and managing your business. You'll use your business plan as a roadmap for how to structure, run, and grow your new business. It's a way to think through the key elements of your business. Business plans can help you get funding or bring on new business partners.

The business plan should have a section that explains the services or products that you're offering. This is the part where you can also describe how they fit in the current market or are ...

Step 7: Financial Analysis and Projections. It doesn't matter if you include a request for funding in your plan, you will want to include a financial analysis here. You'll want to do two things here: Paint a picture of your business's performance in the past and show it will grow in the future.

The steps below will guide you through the process of creating a business plan and what key components you need to include. 1. Create an executive summary. Start with a brief overview of your entire plan. The executive summary should cover your business plan's main points and key takeaways.

Don't forget to download our free business plan template (mentioned just above) so you can follow along as we go. How to Write a Business Plan Step 1. Create a Cover Page. The first thing investors will see is the cover page for your business plan. Make sure it looks professional.

Just highlight the key roles that you need to fill and the type of person you hope to hire for each role. 5. Financial plan and forecasts. Your business plan now covers the "what," the "how," and the "when" for your business. Now it's time to talk about money.

There are plenty of mistakes that can be made when writing a business plan. However, these are the 5 most common that you should do your best to avoid: 1. Not taking the planning process seriously. Having unrealistic financial projections or incomplete financial information. Inconsistent information or simple mistakes.

Learn about the best business plan software. 1. Write an executive summary. This is your elevator pitch. It should include a mission statement, a brief description of the products or services your ...

Here is a guide to help you get started on your business plan: 1. Executive Summary. What It Is: This section summarizes your business plan as a whole and outlines your company profile and goals.

Develop a 3-5 year strategic plan. Your goals and growth targets are "what" you want to achieve. Your strategy is "how" you're going to achieve it. Use your business plan to document your strategy for growth. You might be expanding your product offering, expanding your market, or some combination of the two.